Keith Matthews

Partner & Portfolio Manager

You did it:

A look back on the 2008 financial crisis

This fall marks the tenth anniversary of the 2008 financial crisis. Much has been written about the crisis’ causes and effects, as well as who deserves to take the blame for what happened. This article will approach the crisis from a different direction and give credit to those individuals who, through a disciplined investment approach that focused on principles, planning, and the achievement of long-term goals, were able to survive the crisis and emerge stronger for having done so. I’m speaking, of course, about investors like you.

Late 2008 and early 2009 were worrying days to say the least

When I look back at everything that happened a decade ago, the first thing that comes to mind is how our clients handled the challenges of navigating an uncertain and ever-changing financial landscape. The crisis and its aftermath were of such a scope many of us had never experienced in our lifetimes. Late 2008 and early 2009 were worrying days to say the least. No one knew when the freefall would stop, and there was no shortage of doomsayers predicting that the markets and even the global financial system of which they were a part, would ever recover.

Having worked so hard to build and save your wealth, that moment in time must have delivered a serious shock to your system. I had many discussions over the phone and in person with clients during those difficult months. Even the most stoic of people have their emotions stirred by threats to their financial security. I could see and hear the emotions in your faces and voices as we met in the office or talked on the phone.

Heroes of this Story

It’s one thing to have a plan in place in case of an emergency, but it’s often impossible to know how we are going to react in a given situation until we find ourselves in it for real. Stick to winning principles, follow your plan, maintain a sustainable lifestyle, and focus on achieving your long-term goals instead of preoccupying yourself with short-term distractions. This is what you did in the aftermath of the crisis and that is why you and all of our clients are the heroes of this story.

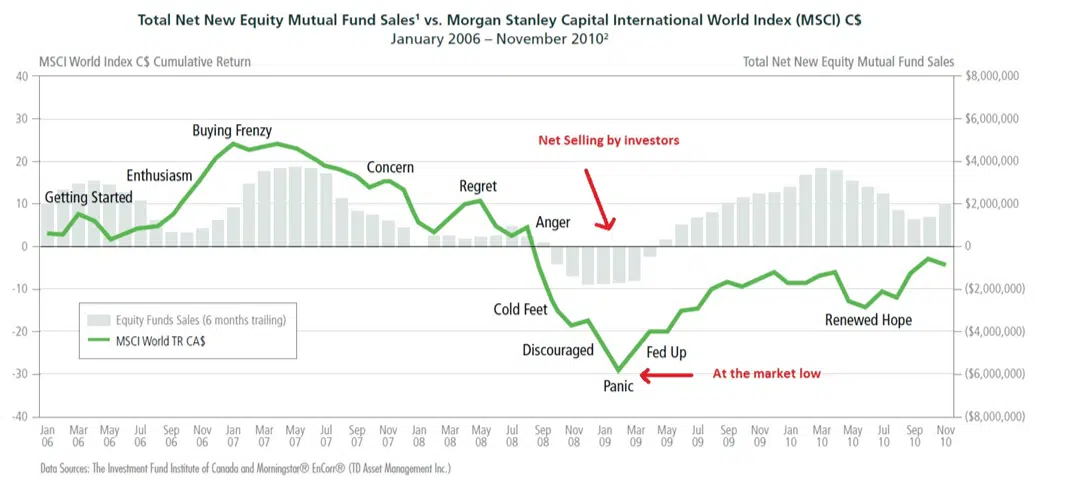

The above chart plots Total Net New Equity Mutual Funds Sales (grey bars) against the Morgan Stanley Capital International World Index (MSCI) in Canadian Dollars. The graph shows that as returns and prices increase, so too do purchases of equity funds. When returns and prices decrease, net selling increases. Put more simply, investors were buying high and selling low.

Winners and Losers

The ‘winners’ of the crash weren’t the ones who saw it coming, just as the ‘losers’ weren’t the ones who failed to predict it. The winners and losers are only decided by what they do after the downturn hits. The winners stayed disciplined, rebalanced, and remained invested while the losers panicked and sold when returns were at their lowest, causing them to miss out on the subsequent recovery and to buy back in when prices were higher. Failing to foresee a correction is an acceptable hazard. Failing to foresee and reap the benefits of a recovery is not. That is why you are a winner.

As your advisor and guide, I have lived and worked through the Russian crisis of 1998, the dot com bubble of 2001, the financial crisis of 2008, the European sovereign debt crisis, and various other periods of increased volatility. I have also witnessed periods of recovery, strong growth, and even record-breaking highs. On March 9, 2009, the Dow Jones reached its lowest point in the aftermath of the crisis at 6,547. A decade later, the Dow is currently at 25,707 (October 17th, 2018).

It is worth pausing to reflect on how we thought, felt, and acted during those difficult days and to compare those thoughts, feelings, and actions with the ones we’ve experienced in better times. What differences should we see between the two? Ideally, none at all. Good times and bad times pass away, yet our guiding principles and philosophy will serve you well in times of plenty and in times of want.

Congratulations

This is a well-earned congratulations to you on the tenth anniversary of the financial crisis for being prepared, hanging tough, and for staying true to the winning guiding principles and investment philosophy. You are the heroes of this story. You kept your head when others panicked during the crisis, thus ensuring that you were in position to benefit from the recovery while those who had sold scrambled to buy back in.

As investors and advisors, we must always be prepared to deal with corrections and periods of anxiety. Though your sense of financial security might get jolted on occasion, rest assured that we will continue to act as your guide and help you follow your plan we developed together to solve your retirement puzzle.

Once again, congratulations on this tenth anniversary. Keep being the heroes of your investment story. It is an honour to be your guide, and we will be here with you every step of the way.

Regards,