While an IPS focuses exclusively on your investments, a personal financial plan is much broader. It focuses on you and your family, bringing all your financial and life goals together into one planning exercise. This includes saving for retirement, debt management, insurance, taxes, and estate planning. Part of becoming an empowered investor is being able to create a sustainable financial future for you and your family. Often, too much is focused on the portfolio while life- affecting financial concepts are neglected.

Do you know when you want to retire and do you know how much money you need to make it happen? Do you know how much you should be saving for your children’s education or for your dream cottage? What planning strategies could help you save taxes? Do you have the proper risk management and safety nets in place? Most Canadians do not know the answers to these questions. For example, according to a poll conducted by Tangerine (formerly ING Direct) in 2012, more than

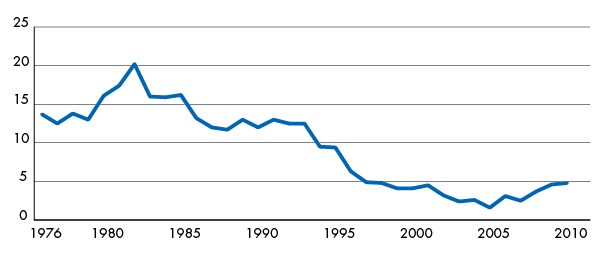

Unfortunately, retiring comfortably will be a challenge for many Canadians: in fact, many younger baby-boomers and the members of Generation X (born between the mid-1960s and late 1970s) will experience a lower standard of living than their parents. Those who raised families during the late 1990s and 2000s often bore the weight of big mortgages and stagnating wages, and few have defined benefit pension plans at work. They also did not inherit the frugality of previous generations; as Figure 1 demonstrates savings rates today are extremely low and many use lines of credit to live beyond their means. In the past, Canadians saved with discipline and diligence through some of the toughest financial periods. Empowered investors understand that they need to return to that philosophy.

For those who are serious about planning for the future, a comfortable retirement is still within reach. The important first step is to create a personal financial plan.

Figure 1: Personal Savings as a Percentage of Personal Disposable (After Tax) Income

How to Know If You Need a Financial Plan

Most, if not all, Canadians need some type of financial plan or guide, often at multiple stages in their lives. The following questions can help you to decide whether you need professional help in putting your plan together:

- Do you know how much total investment wealth is required to finance your retirement?

- Do you know how much you should be saving on an annual basis to reach your retirement goals?

- Do you have the time to attend to your personal financial affairs?

- Are you confused about conflicting financial advice from several sources?

- Do you feel that you are paying too much tax?

- Do you feel that you can’t make ends meet?

- Do you feel that you can’t save any money?

- Has there been a recent change in your life that could affect your

financial future, such as retirement, job loss, an inheritance, the sale or purchase of a business,

an addition to your family, or the loss of your spouse? The six-step financial planning process highlighted in Figure 3 is a set of guidelines adopted by many financial planning associations around the world. It will help you and your family better understand how financial planning professionals can work with you to help you achieve your personal goals.

One Size Doesn’t Fit All

The financial planning process is an important exercise in striving to control your personal and financial destiny. As the American politician Robert F. Bennett wrote: “Your life is the sum result of all the choices you make, both consciously and unconsciously. If you can control the process of choosing, you can take control of all aspects of your life. You can find the freedom that comes from being in charge of yourself.”

Everyone has different goals and challenges, and no two family circumstances look alike. There are so many things in life that make us unique. We make important life decisions—to own a business or be an employee, to get married or remain single, to have children or not, to retire early or to continue to work as long as possible. When you add life’s many challenges (both pleasant and unpleasant) to the equation, you can see how financial planning can become a very personal life-planning exercise.

Figure 2: The Six Step Financial Planning Process

Step 1: Establish the client-planner relationship by clarifying the responsibilities of the planner and the client.

Step 2: Identify your personal goals and objectives by collecting and assessing all relevant financial data—assets and liabilities, tax returns, investments, insurance policies, wills, and pension plans.

Step 3: Identify and

Step 4: Create a written plan with recommendations structured to meet your needs without undue emphasis on purchasing specific investment products.

Step 5: Implement your personal financial plan to ensure that you reach your goals and objectives.

Step 6: Schedule a periodic review and revision of your plan to ensure that you achieve your goals.

There are also many dimensions or phases within a personal financial plan that will depend on what life stage you are at (see Figure 3 for financial planning phases). Individuals, couples, and families evolve through these dimensions and phases over time; their financial priorities will do so as well.

Putting It All Together

Your portfolio is just one part of an overall financial strategy. By integrating your investment strategy with your financial plan, you’ll enjoy the confidence, comfort, and peace of mind that come from knowing that your money is working for your interests. This will allow you to concentrate your energy and passion on the things that matter most: your family, your friends, your business or profession, your hobbies, and your retirement.

Figure 3: Financial Planning Phases

| ACCUMULATION (ages 25–50) |

PRE-RETIREMENT (ages 50–70) |

RETIREMENT (ages 65–90) |

|---|---|---|

| Saving 10 to 20% of family earnings | Increase savings to 20% or more of family earnings | Determining a sustainable portfolio draw-down rate |

| Debt elimination | Debt elimination | Debt elimination |

| Children’s education | ||

| Protecting your family with insurance | Protecting your family with insurance | |

| Wills & POAs up-to-date | Wills & POAs up-to-date | |

| Leaving a legacy or not | ||

| Charitable giving | ||

| Investment Focus: Long-term growth |

Investment Focus: Moderate growth |

Investment Focus: Capital preservation with some growth |