2025 Market Review

Strong Results, Uneven Paths

Investors can look back on 2025 as a year that delivered exceptional stock market results. Headline returns were impressive, but the path was bumpy. Throughout the year, markets navigated tariff surprises, geopolitical events, artificial intelligence developments, and renewed debates about valuations and market concentration.

This experience has become familiar. In recent years, markets have repeatedly shown that progress rarely arrives in a straight line. Historically, some of the strongest stock market returns have emerged during periods of heightened uncertainty, often well before that uncertainty is resolved. Once again in 2025, investors who remained disciplined, focused on diversification rather than short-term headlines were rewarded.

It has been a remarkable past few years for equity returns. Since January 1, 2023, the MSCI All Country World Index has surged a whopping 75.1%, or 20.52% annualized.

2025 Performance by asset class (in CAD):

-

-

- Canadian stocks: +31.68%

- U.S. stocks: +12.56%

- International stocks: +25.30%

- Emerging market stocks: +27.54%

- Canadian bonds: +2.64%

- Global REITs: +2.81%

-

2025 was also a year of meaningful rotation. Market leadership shifted across regions and investment styles, challenging assumptions that had dominated recent commentary. Canada and international markets exceeded expectations, value and small-cap stocks re-emerged as meaningful contributors, and the narrative of persistent U.S. market dominance softened.

The lessons of the year extend beyond any single return figure. They reinforce enduring investment principles: the importance of global diversification, realistic expectations, and maintaining a long-term perspective when markets inevitably move in unexpected ways.

Exhibit 1: 2025 Index Returns (in Canadian dollars)

| Fixed Income | |

| Cash and Equivalents | +2.73% |

| World Government Bond Index 1–5 Years | +3.26% |

| World Aggregate Credit Index 1-5 Year | +4.47% |

| Canadian Short-Term | +3.88% |

| Canadian Bond Universe | +2.64% |

| Canadian Equity | |

| Canadian Stocks (S&P/TSX Composite Index) | +31.68% |

| Canadian Value Stocks | +34.47% |

| Canadian Small Value Stocks | +40.85% |

| US Equity | |

| US Stocks (S&P 500 Index) | +12.56% |

| US Value Stocks | +10.49% |

| US Small Value Stocks | +7.51% |

| Developed International Equity | |

| International Stocks (MSCI EAFE) | +12.56% |

| International Value Stocks | +10.49% |

| International Small Value Stocks | +7.51% |

| Emerging Market Equity | |

| Emerging Market Stocks (MSCI Emerging Market) | +27.54% |

| Emerging Market Value Stocks | +26.75% |

| Emerging Markets Small Value Stocks | +13.45% |

| Real Estate investment Trusts (REITS) | |

| Global REITS | +2.81% |

| Canadian REITs | +9.58% |

| Currencies | |

| Canadian Dollar vs USD | +4.73% |

| Canadian Dollar vs Euro | -7.69% |

| Canadian Dollar vs Australian Dollar | -2.87% |

| Note: Indexes are in the endnotes of this commentary |

TMA Model Portfolio Returns

Highlights of our client portfolios:

-

Equities are globally diversified across Canada, the US, developed, and emerging international markets with over 10,000 companies.

-

Portfolios include growth companies but have higher exposure to value companies.

-

Portfolios include large, mid, and small capitalization companies.

Exhibit 2: 2025 TMA Model Portfolio Returns

| 30% Equity 70% Bonds | +9.19% |

| 50% Equity 50% Bonds | +13.26% |

| 60% Equity 40% Bonds | 15.33% |

| 65% Equity 35% Bonds | +16.37% |

| 75% Equity 25% Bonds | +18.43% |

| 100% Equity | +24.02% |

| Note: Actual client portfolios may differ due to slightly different asset allocations. These returns are before TMA management fees. Source: Portfolio constituents available in the endnotes of this commentary. |

2025 World Stock Markets Deliver… again

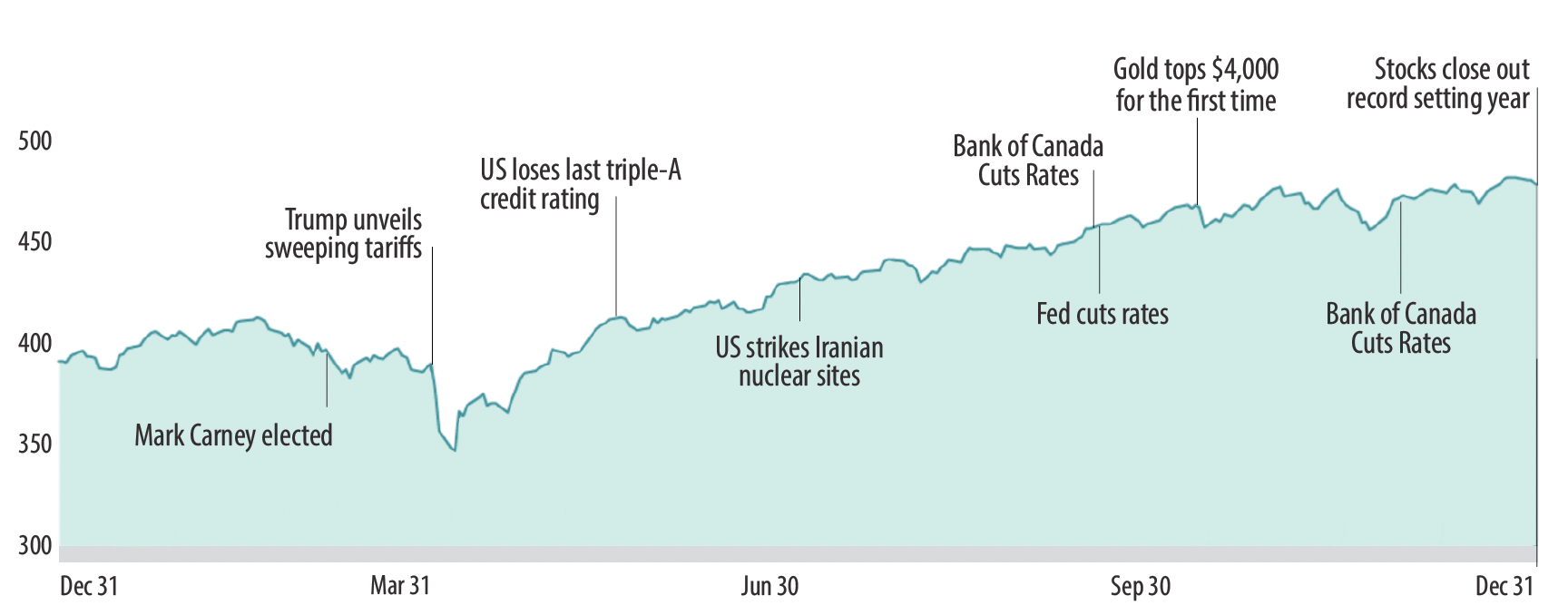

Exhibit 3 below presents select headlines from the year, along with global market moves, as measured by the MSCI All Country World Index. Throughout the year, there were plenty of events sowing seeds of doubt around the world, most notably the US tariffs introduced by the US Administration in April 2025. But these headlines were better viewed as a test of investor discipline throughout the year, instead of as determinants of the market’s overall direction.

As long-term investors we are in pursuit of long-term returns, which are often delivered just when we least expect them. Thus, investors are best served by tuning out the headlines and committing to a long-term investment approach, unaffected by the daily news.

Exhibit 3: MSCI All Country World Index with select 2024 headlines.

MSCI data © MSCI 2025, all rights reserved. Indices are not available for direct investment. Performance does not reflect expenses associated with the management of an actual portfolio.

Rotation in Returns: U.S. to Canadian and International Stocks

In both 2023 and 2024, the dominant market narrative was U.S. exceptionalism. Strong economic growth, robust corporate profits, and extraordinary performance from a handful of large U.S. technology companies led many commentators to suggest that the U.S. market was uniquely positioned to outperform indefinitely.

In 2025, that narrative softened.

Canadian and International equities delivered very strong results, while U.S. markets lagged global peers. The Canadian stock market rose by 31.68%, driven by materials and mining, as well as financials and energy. Canadian stocks closed out 2025 with the second best year since 2000.

This reversal of leadership was not a surprise, at least not from a long-term investing perspective. Market leadership has always rotated, often at precisely the moment when confidence in the previous leader feels most entrenched.

Over the past 15 years, the U.S. stock market has generally outperformed other countries, earning a reputation for being “exceptional.” Much of this outperformance in recent years has been driven by mega-cap technology companies, particularly with the rise of artificial intelligence over the last five years.

However, that trend has shifted this year, with Canadian stocks delivering standout returns. Exhibit 4 below ranks DFA’s core equity strategy’s calendar returns from 2020-2025 from best to worst: Canadian Core (orange), U.S. Core (blue), and International Core (gold).

Exhibit 4: Ranking Dimensional Core Equity Strategy Returns

Calendar Year Returns 2020 2021 2022 2023 2024 2025 Best returns 11.90% 28.70% 1.00% 18.70% 30.00% 35.50% 6.30% 26.80% -8.90% 14.10% 20.70% 26.40% Worst returns 0.30% 9.00% -9.50% 9.50% 12.50% 10.40%

Exhibit 5 below, ranks from best to worst the 5-year annualized returns for Dimensional Core positions, Dimensional Vector positions, and the benchmark for each region, respectively.

Surprisingly, Dimensional’s Canadian equity strategies now have higher 5-year annualized returns than the S&P 500. Vector positions are similar to that of Core, with slightly higher weighting towards value and small cap companies.

Exhibit 5: Ranking 5-year Annualized Returns

5-year Annualized Returns, as of December 31, 2025 Investment Strategy and/or Benchmark Annualized Return Best returns DFA Canada Vector 21.20% DFA Canada Core 18.40% S&P 500 Index 16.20% S&P/TSX Composite Index 16.10% DFA U.S. Core 14.50% DFA U.S. Vector 13.60% DFA International Vector 10.70% DFA International Core 9.90% Worst returns MSCI EAFE + Emg Markets Index 9.10%

These ranking tables underscore the importance of maintaining a globally diversified portfolio. It highlights two key points:

-

- Country-level performance is unpredictable, it is extremely difficult to consistently identify which region will lead in any given year; and

- Strong past performance doesn’t guarantee future success. By investing across global markets, you increase your chances of benefiting from whichever countries are outperforming at any given time.

AI Mania: Bubble or Revolution?

There has been growing discussion about whether today’s enthusiasm around AI resembles the technology boom of the late 1990s.

History shows that transformative technologies often arrive alongside high expectations, rapid investment, and early winners, long before the ultimate economic and investment outcomes become clear.

Valuations & Uncertainty

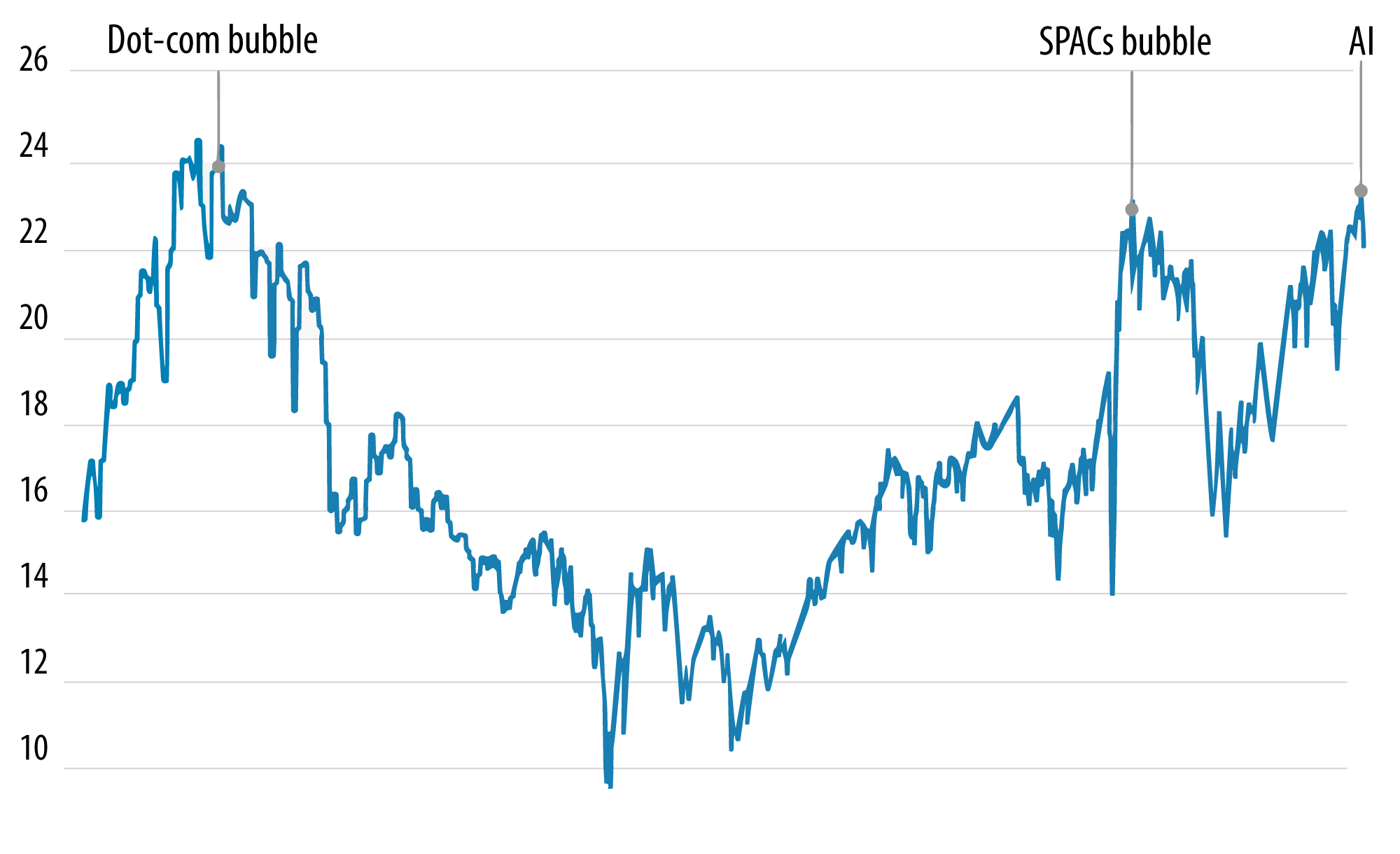

As interest in AI-related companies has increased, so have valuations. By several widely used measures, U.S. equity valuations have reached levels last seen during the late-1990s technology boom. Much like during the dot-com era, investors have been willing to pay higher prices based on the belief that AI will lead to rapid and sustained profit growth.

Exhibit 6: Highly Valued – S&P 500 12-month forward price-to-earnings ratio

Source: The Wallstreet Journal, LSEG

High valuations do not automatically signal an imminent market decline. However, they do tend to lower expected future returns. When expectations are elevated, even strong business results can fall short of what investors are hoping for.

As with past technology cycles, the long-term economic impact of AI remains difficult to quantify. While today’s leading AI companies generate real revenues, unlike many firms during the dot-com era, those profits have not yet fully justified the level of expectations reflected in current prices.

Investment

The scale of investment behind AI is enormous. Just as the internet required heavy spending on fibre-optic networks in the 1990s, AI today is driving significant investment in data centres, computer chips, and power infrastructure. Some of this spending will undoubtedly prove valuable.

That said, history reminds us that major economic breakthroughs do not always translate into strong investment returns, particularly when large amounts of capital are deployed quickly and optimism move ahead of reality.

Exponential Growth

One notable difference between today’s AI-driven rally and the late-1990s technology boom is the scale of stock price gains. While AI-related stocks have risen sharply, their advances have been far smaller than the extreme surges seen during the dot-com era.

During that period, several technology stocks more than doubled in a matter of months. Cisco doubled in just four months in late 1999, while companies such as Apple and Intel rose by 75% to 150% over short periods. Others, like Qualcomm, surged more than 2,000% before eventually collapsing and taking decades to recover.

Although today’s AI leaders have delivered impressive returns, the magnitude of those gains remains lower than the exponential moves seen in 1999–2000. This distinction matters because extreme price gains tend to amplify both investor enthusiasm and subsequent disappointment.

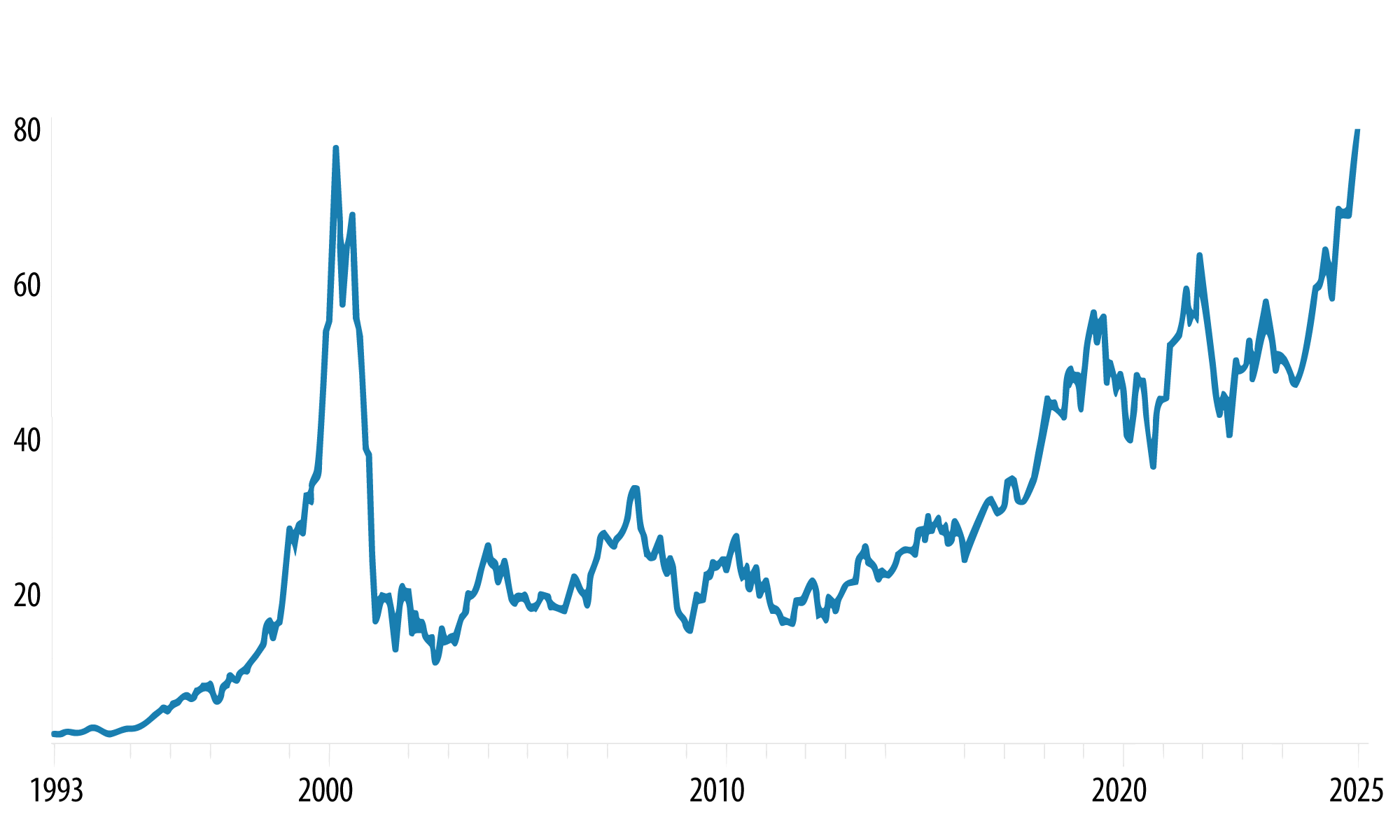

Cisco: A Cautionary Tale

Cisco’s decades-long recovery remains a cautionary tale against assuming today’s leaders will be market leaders in the future.

Cisco, was one of the dot-com era’s most celebrated internet stocks and the world’s most valuable company at its peak in March 2000, did not regain that high until late 2025.

Exhibit 7: It Hurts When Bubbles Pop – Cisco Systems share price

Source: The Wallstreet Journal, FactSet

While artificial intelligence is clearly here to stay, its economic impact is unlikely to be limited to a small group of technology companies. Over time, AI is expected to improve productivity and decision-making across many industries, and the eventual beneficiaries may look very different from today’s market leaders.

For investors, this reinforces a central principle: rather than trying to predict which AI companies will succeed, a disciplined and diversified approach, investing across thousands of global stocks, allows investors to participate broadly in innovation. As markets evolve, companies that deliver lasting value will organically become larger holdings of diversified portfolios.

Value and Small-Cap Stocks Back in Vogue

Value and small cap stocks experienced a recent turnaround and have rewarded investors who remained disciplined.

In 2025, TMA client portfolios have experienced strong relative equity returns (See Exhibit 8), as value and small cap stocks outperformed broad indices, as well as growth stocks. As part of our long-term investment philosophy, we have held long-term overweight positions to value and small cap companies by way of broadly diversified Dimensional equity strategies.

Exhibit 8: DFA Core Strategy vs Broad Benchmark

DFA Core Equity Funds versus Broad Equity Benchmark (December 31, 2025, in CAD)

| DFA Core Strategy | Broad Benchmark | Outperformance | |

| Canadian equities | 35.53% | 31.68% | 3.85% |

| US equities | 10.38% | 11.86% | -1.48% |

| International equities | 26.40% | 26.06% | 0.34% |

| Canadian equities outperformance measured by DFA Canadian Core Fund (F) minus S&P/TSX Composite Index. US equities outperformance measured by DFA US Core Fund (F) minus Russell 3000 Index. International; equities outperformance measured by DFA International Core Fund (F) minus MSCI EAFE + EM Index. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio. |

History shows that leadership between growth and value, as well as between large and small companies, tends to rotate over time – often after extended periods of underperformance. The experience of 2025 served as another reminder that diversification across investment styles is just as important as diversification across regions or sectors.

How Did 2025 TMA Model Portfolios Perform?

Exhibit 9: TMA Model Portfolio Returns (as of December 31st, 2025)

The table below lists various TMA portfolio allocations using Dimensional asset class strategies and their respective annual returns from 2006–2025.

2025 and Calendar Year TMA Model Portfolio Returns

| Date | 30% Equity 70% Bonds | 50% Equity 50% Bonds | 60% Equity 40% Bonds | 65% Equity 35% Bonds | 75% Equity 25% Bonds | 100% Equity |

|---|---|---|---|---|---|---|

| 2006 | 7.87% | 11.43% | 13.22% | 14.11% | 15.90% | 20.44% |

| 2007 | 1.54% | -0.26% | -1.15% | -1.60% | -2.49% | -4.64% |

| 2008 | -7.01% | -13.99% | -17.35% | -19.00% | -22.23% | -29.96% |

| 2009 | 10.40% | 14.53% | 16.59% | 17.62% | 19.67% | 24.90% |

| 2010 (1) | 8.52% | 10.23% | 11.05% | 11.45% | 12.05% | 14.17% |

| 2011 | 1.96% | -1.12% | -2.69% | -3.46% | -5.34% | -9.05% |

| 2012 | 7.65% | 9.13% | 9.86% | 10.22% | 10.94% | 12.66% |

| 2013 | 6.83% | 12.18% | 14.94% | 16.32% | 19.38% | 26.27% |

| 2014 | 6.59% | 7.37% | 7.74% | 7.95% | 7.93% | 9.19% |

| 2015 | 3.18% | 4.08% | 4.51% | 4.73% | 5.12% | 6.17% |

| 2016 (2) | 6.09% | 8.24% | 9.31% | 9.85% | 10.49% | 13.54% |

| 2017 | 5.55% | 7.80% | 8.94% | 9.51% | 10.40% | 13.59% |

| 2018 | -1.87% | -3.38% | -4.14% | -4.53% | -5.27% | -7.30% |

| 2019 | 9.49% | 11.95% | 13.19% | 13.81% | 14.63% | 18.22% |

| 2020 | 5.16% | 5.89% | 6.13% | 6.22% | 5.98% | 6.24% |

| 2021 | 5.13% | 9.60% | 11.87% | 13.03% | 15.53% | 21.32% |

| 2022 | -8.35% | -7.51% | -7.11% | -6.91% | -5.82% | -5.61% |

| 2023 | 8.38% | 10.00% | 10.81% | 11.22% | 11.73% | 14.09% |

| 2024 | 8.73% | 12.14% | 13.86% | 14.74% | 16.73% | 20.88% |

| 2025 | 9.19% | 13.26% | 15.33% | 16.37% | 18.43% | 24.02% |

| Summary Statistics (January 1st 2006 to Dec 31st 2025) | ||||||

| 1-Year Return | 9.19% | 13.26% | 15.33% | 16.37% | 18.43% | 24.02% |

| 3-Year Return | 8.43% | 11.55% | 13.13% | 13.92% | 15.52% | 19.56% |

| 5-Year Return | 4.69% | 7.43% | 8.81% | 9.50% | 10.89% | 14.37% |

| 10-Year Return | 4.37% | 6.43% | 7.45% | 7.95% | 8.95% | 11.38% |

| 18-Year Return | 4.41% | 5.66% | 6.25% | 6.54% | 7.11% | 8.43% |

| Growth of $1 | $2.37 | $3.01 | $3.36 | $3.55 | $3.95 | $5.05 |

| Standard Deviation | 3.98% | 6.20% | 7.36% | 7.95% | 9.13% | 12.13% |

| Actual client portfolios may differ due to slightly different asset allocations. Model portfolio returns are before TMA management fees but after Dimensional Fund Advisor management fees. (1): As of January 1st, 2010, TMA Model Portfolios include DFA Investment Grade Fixed Income (F). (2) As of January 1st, 2015, TMA Model Portfolios include DFA Targeted Credit Fund (F). |

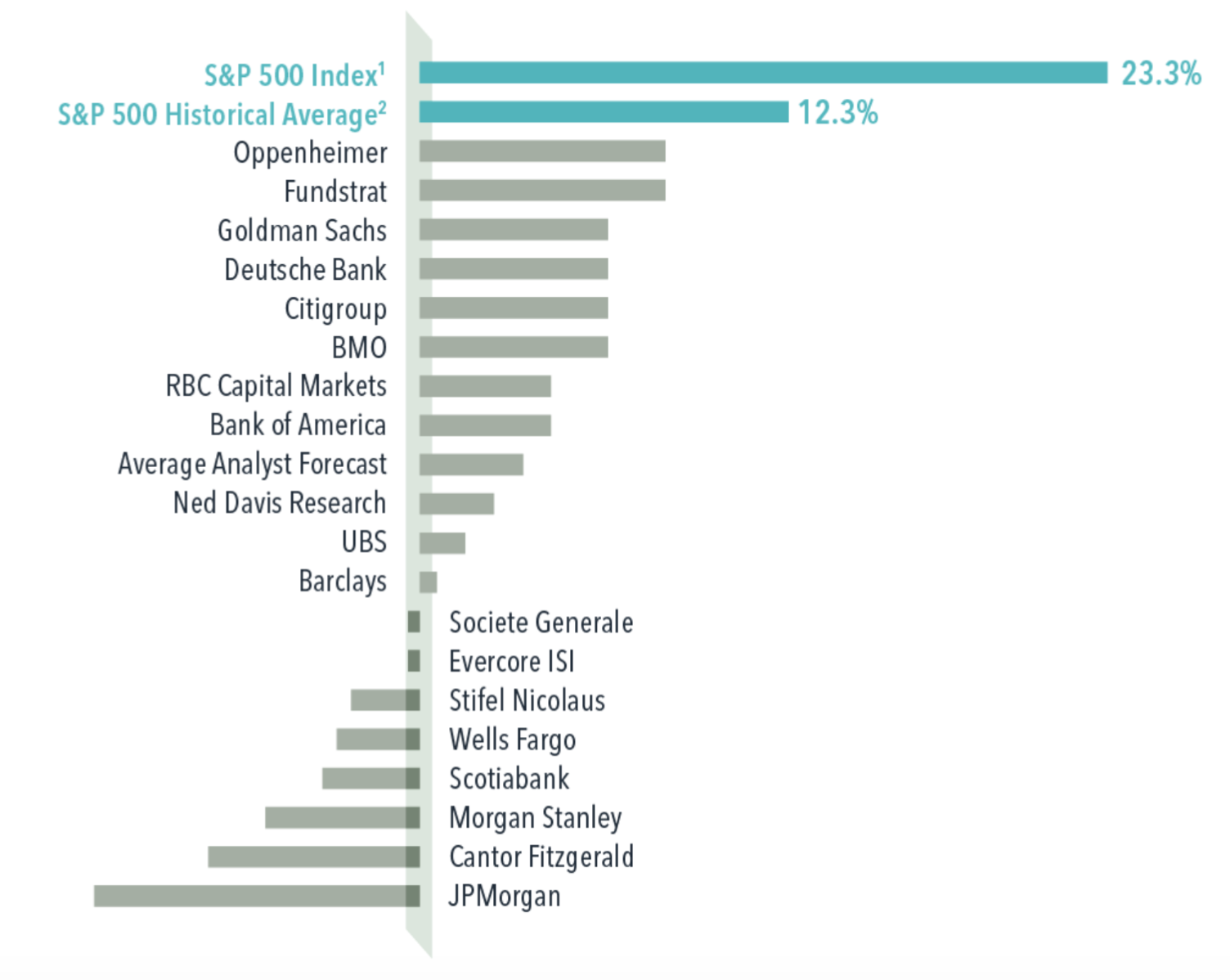

When the Crystal Ball Is a Little Cloudy

As the calendar year comes to an end, market forecasts inevitably reappear. Strategists publish year-ahead targets, commentators debate risks and opportunities, and investors are once again presented with confident predictions about what markets will do next.

History suggests a healthy dose of skepticism is warranted.

Predicting short-term market returns is extraordinarily difficult. Research shows that, even among the most accurate equity analysts, forecasts over recent years were typically about 20% off, sometimes by much more.

The experience of 2024 provides a clear example. At the end of 2023, analysts’ expectations for the S&P 500 varied widely, with nearly half predicting a negative year. Instead, the market rose more than 23% (in USD), far exceeding both the historical average return and the full range of professional forecasts.

Exhibit 10: Equity analyst predictions vs. S&P 500 Index calendar year return in 2024

In USD. Past performance is not a guarantee of future results. Price-only return. Based on actual S&P 500 Index average annual total return from 1927 to 2024. Source: Bloomberg, using the “Strategists S&P 500 Index Estimates for Year-End 2024” as of December 19, 2023. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global.

This persistent forecasting gap is not a failure of intelligence or effort. Markets are forward-looking, and prices already reflect the collective expectations of millions of participants. Actual returns, however, are driven by an unexpected component, events that are unknowable in advance.

Markets quickly incorporate widely held expectations, leaving investors who act on predictions reacting to yesterday’s news. The greater risk is not missing the “right” forecast but allowing short-term predictions to disrupt a long-term plan.

Rather than attempting to anticipate what markets will do next year, history suggests a more reliable approach is to focus on what markets have delivered over time, and on maintaining an investment strategy designed to endure across a wide range of possible futures. That discipline has consistently mattered far more than prediction.

Valuations and What to Expect Going Forward

The past several years has been exceptionally strong for equity investors. One-, three-, and five-year returns for global equities have all exceeded long-term historical averages.

For the last 100 years, global equities have delivered an average annual return of 9.7%, albeit with significant variation along the way. The last three years have provided more than double this long-term average – a whopping average annual rate of 21.72%. Periods of unusually strong returns tend to “pull forward” future gains, lowering expected returns over subsequent years.

This remarkable bull-run suggests that forward-looking expected returns are likely more muted, or at least closer to long-term averages, than what investors have experienced recently. The implication for investors is not to reduce exposure or attempt to time markets. Rather, it is a reminder to manage expectations and to remain disciplined.

Looking Ahead

Uncertainty will remain a constant feature of investing, just as it always has been. Market leadership will continue to rotate, narratives will rise and fall, and surprises will shape returns in ways no forecast can anticipate.

What does not change is our commitment to:

- global diversification,

- evidence-based investing,

- and helping clients stay focused on long-term goals rather than short-term noise.

At Tulett, Matthews & Associates, we are committed to helping you stay focused on your goals, tuning out daily market noise, and maintaining confidence in your plan.

We look forward to connecting with you soon. In the meantime, please reach out with any questions or concerns—we’re here to help.

From all of us at Tulett, Matthews & Associates, we wish you a happy and healthy 2026.

The Empowered Investor Podcast:

We are committed to bringing our clients perspective, awareness, and continued education. And perspective matters. Our Empowered Investor Podcast is a way for us to help bring you perspectives. Attached below is a full list of our 2025 episodes:

- Human Capital: 5 Guiding Career Principles with Mark Halloran

- Don’t let Your Advisor’s Retirement Disrupt Yours

- How to Calculate your Retirement Spending

- The Index Investing Revolution: Lessons from “Tune out the Noise”

- Canadian Wealth Management Is Changing: 4 Trends Investors Can’t Ignore

- Canadian Retirement: Myths, Realities, and Smart Planning Strategies

- 2025 Mid-Year Investment Review

- Global Investors, Shared Values: A Conversation with David Andrew

- RESP 101: What Every Empowered Parent Needs to Know

- Personal Finance with La Presse’s Acclaimed Nicolas Bérubé

- Market Volatility and Trump’s Tariff Wars

- Essential Tax Tips to Complete your 2024 Tax Returns

- Chasing Trends, Losing Wealth: The Tactical Allocation Trap

- Does Money Buy Happiness?

- US-Canada Tariffs, Trade & Investor Impact

- Maximize your Savings with the Right Investment Accounts in 2025

- 2024 Financial Year in Review and Looking Ahead for 2025

Endnotes:

Exhibit 1:

FTSE Canada 30-day T-Bill, FTSE World Government Bond Index 1–5 Years (hedged to CAD), Bloomberg Global Aggregate Credit Bond Index 1-5 Years (hedged to CAD), FTSE TMX Canada Short-Term Bond Index, FTSE Canada Universe Bond Index, S&P/TSX Composite Index, MSCI Canada Value Index, MSCI Canada Small Value Index (net div.), S&P 500 Index, Russell 3000 Value Index, Russell 2000 Value Index, MSCI EAFE Index (net div.), MSCI EAFE Value Index (net div.), MSCI EAFE Small Value Index (net div.), MSCI Emerging Market Index (net div.), MSCI Emerging Markets Value Index (net div.), MSCI Emerging Markets Small Value Index (net div.), S&P/TSX Capped REIT Index and the S&P Global REIT Index (net div.). Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio.

Exhibit 2:

In CAD. Performance is net of DFA management expense ratio (MER) but before TMA management fees.

100EQ/0FI:

DFA Canada Canadian Core Equity Fund Class F: 33.3400%, DFA Canada International Core Equity Fund Class F: 33.3300%, DFA Canada US Core Equity Fund Class F: 33.3300%.

75EQ/25FI:

DFA Canada Canadian Core Equity Fund Class F: 25.00%, DFA Canada Five-Year Global Fixed Income Fund Class F: 12.500%, DFA Canada International Core Equity Fund Class F: 25.00%, DFA Canada US Core Equity Fund Class F: 25.00%, DFA Canada Global Targeted Credit Fund Class F: 12.500%.

65EQ/35FI:

DFA Canada Canadian Core Equity Fund Class F: 21.6700%, DFA Canada Five-Year Global Fixed Income Fund Class F: 11.6700%, DFA Canada Global Investment Grade Fixed Income Fund – Class F: 11.6600%, DFA Canada International Core Equity Fund Class F: 21.6600%, DFA Canada US Core Equity Fund Class F: 21.6700%, DFA Canada Global Targeted Credit Fund Class F: 11.6700%.

60EQ/40FI:

DFA Canada Canadian Core Equity Fund Class F: 20.0%, DFA Canada Five-Year Global Fixed Income Fund Class F: 13.3400%, DFA Canada Global Investment Grade Fixed Income Fund – Class F: 13.3300%, DFA Canada International Core Equity Fund Class F: 20.0%, DFA Canada US Core Equity Fund Class F: 20.0%, DFA Canada Global Targeted Credit Fund Class F: 13.3300%.

50EQ/50FI:

DFA Canada Canadian Core Equity Fund Class F: 16.6700%, DFA Canada Five-Year Global Fixed Income Fund Class F: 16.6700%, DFA Canada Global Investment Grade Fixed Income Fund – Class F: 16.6600%, DFA Canada International Core Equity Fund Class F: 16.6600%, DFA Canada US Core Equity Fund Class F: 16.6700%, DFA Canada Global Targeted Credit Fund Class F: 16.6700%

30EQ/70FI:

DFA Canada Canadian Core Equity Fund Class F: 10.0%, DFA Canada Five-Year Global Fixed Income Fund Class F: 23.3400%, DFA Canada Global Investment Grade Fixed Income Fund – Class F: 23.3300%, DFA Canada International Core Equity Fund Class F: 10.0%, DFA Canada US Core Equity Fund Class F: 10.0%, DFA Canada Global Targeted Credit Fund Class F: 23.3300%

Our Approach

Contact

3535 St-Charles Bvld

Suite 703

Kirkland (Québec) H9H 5B9

Connect