the empowered investor

Investment Principal #2: Diversify Your Asset Classes

Why Should You Diversify, and How Is It Often Easier Said Than Done?

Key Takeaways

- After asset class investing, diversification is the second of four key components essential to every evidence-based investment portfolio.

- Nobel Laureate Harry Markowitz introduced the concept in the 1950s. He showed how investors could enjoy a smoother ride, and pursue higher expected returns by focusing on building a well-diversified portfolio, instead of picking securities in isolation.

- The magic behind diversification is found in a financial measure known as correlation, or the degree to which two asset classes move in similar patterns.

- Diversification offers a number of benefits and isn’t hard to implement. And yet, it’s often easier said than done, for a number of practical and behavioural reasons.

- By familiarizing yourself with the challenges (including investor home bias in our relatively concentrated Canadian markets), you can more effectively overcome them.

Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserve.

In our last post, Invest in Asset Classes, we introduced asset class investing as the first of four key components essential to every evidence-based investment portfolio. However, in an arm-wrestling contest, you wouldn’t want to place bets on which is more powerful: asset class investing, or our next component, diversification. It would be better to think of them as a handshake, because they go hand in hand in our list of investment essentials, covered here and in our book, The Empowered Investor:

- Asset class investing

- Diversification

- Passive or index-based market exposure

- Return factors

With so many globally diversified investment funds available these days, it’s not hard to achieve effective diversification by not putting all your investment eggs into one asset class basket. And yet, if you’re unaware of the evidence behind diversification, you may be going through the motions, without really knowing why. This can lead straight into the common pitfalls we covered earlier in Why Diversified Investing Is the Hardest, Easiest Thing To Do.

Today, we’ll provide the essential foundation you need to be among the elite Canadians who know how and why they’ve created a truly diversified investment portfolio.

The Revolutionary History of Diversification

First, let’s pose a fundamental question: Why bother to diversify? Once upon a time (before the 1950s), hardly anyone did. You’d select individual securities based on the latest hot trends and popular speculations. You wouldn’t care which asset classes your investments fell into, in what proportion (as described in our last post, Invest in Asset Classes ). Even if you wanted to care, the logistics made it practically impossible. Stock certificates, real estate deeds, and bonds were all pieces of paper you held in your hand. There were no retail mutual funds, let alone ETFs.

Then, along came Harry Markowitz. In 1952, as a University of Chicago graduate student (and future Nobel Laureate), he published his seminal paper Portfolio Selection in The Journal of Finance. In it, he described how investors could reduce overall portfolio risk and increase expected returns by combining asset classes that behave differently from one another and have good prospects for delivering long-term returns.

Markowitz’s paper became the cornerstone to Modern Portfolio Theory, which suggests, instead of picking securities in isolation, investors can enjoy a smoother ride, and pursue higher expected returns by focusing on building a total, well-diversified portfolio.

The source of this counterintuitive magic lies in a financial measure known as correlation.

Correlation: Diversification’s “Magic Wand”

Correlation measures the degree to which two asset classes move in similar patterns. Highly correlated asset classes are more likely to move in tandem. Asset classes with low or negative correlation are more likely to move out of sync. There may be no relationship between them, or there may be an opposite relationship, where one tends to “zig” when the other is “zagging.”

Correlation measures can fall anywhere between –1 and +1. A correlation of “1” between two asset classes indicates they behave identically. If the correlation between two asset classes is less than 1, diversification benefits exist. Typically, we seek to combine asset classes with positive correlation ranging from 0.30 for the most dissimilar asset classes to 0.95 for the most similar ones.

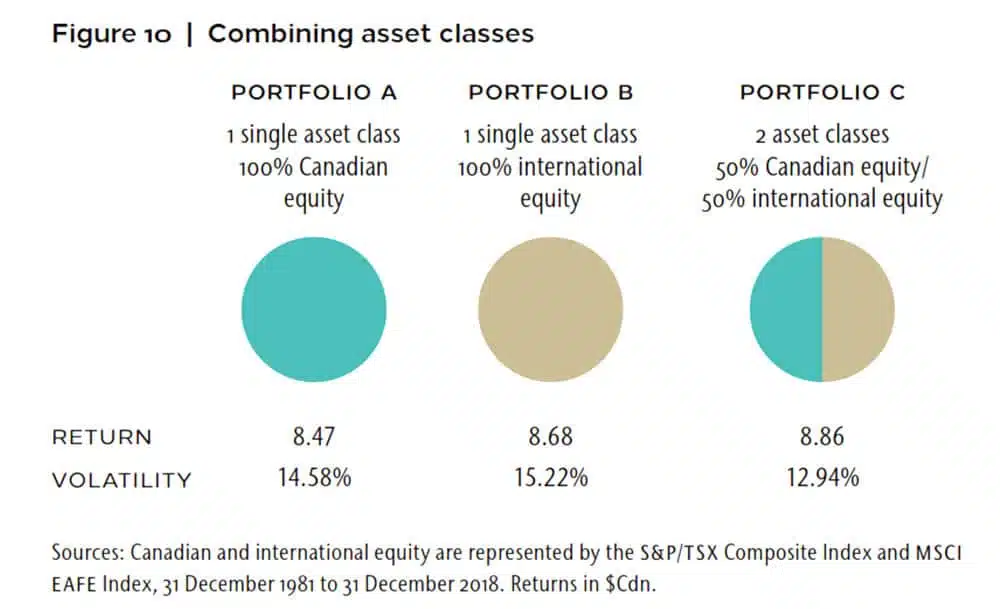

An illustration may help. Consider these three, highly simplified model portfolios:

In Portfolios A and B, 100 per cent of the investment is in a single asset class: Canadian equity for Portfolio A and international equity for Portfolio B. The magic occurs when you combine Portfolios A and B into a Portfolio C. The new rates of risk and return are not, as one might expect, the average of their individual rates. Instead, not only is Portfolio C much less volatile, it also generates a slightly higher return than either of the original portfolios. That’s because, in the timeframe we created this illustration, the correlation between Canadian and international equities was a relatively low 0.49.

What’s So Great About Diversification?

The power of diversification has become increasingly evident over the years, with other academics building on Markowitz’s work. Over the years, it’s been embraced first by institutional investors (with more resources) and eventually by many retail investors (once mutual funds and ETFs came along). Diversifying across global stock, bond, and real estate asset classes can improve on the following:

Risk/Return Outcomes: A thoughtfully diversified portfolio of asset class investments offers higher rates of expected return for each unit of risk you are willing to take.

Managing the Unknown: By spreading your risks across multiple asset classes, you reduce the likelihood all your holdings will plummet at once during market downturns or during “Black Swan” events that are, by definition, impossible to predict, and therefore impossible to prepare for.

Investment Clarity: Having a structured process for building and maintaining a diversified portfolio of non-correlated asset classes can help you tune out the distractions and achieve enhanced personal serenity.

A “Free Lunch”: Nearly everything else in the investment world comes at a cost. And yet, these days, a diversified, evidence-based portfolio should cost less, deliver more, and be easier to implement than a more speculative approach. As financial author Larry Swedroe has advised, “Diversifying stock exposure internationally is a free lunch, so eat lots of it.”

Why Isn’t Everyone Diversified?

If diversification is so tasty, why isn’t everyone doing it? There are several hurdles that can trip even a well-intentioned investor.

Concentrated Canadian Markets: Canada is a relatively concentrated market, with nearly half of its equity in either financial or energy sectors. So, even if you’re invested in a broad Canadian index fund, many of your holdings are likely invested in just those two sectors.

Home Bias: Combine the preceding point with a universal investor “home bias”, and it means many Canadians are not nearly as diversified as they might think. A 2017 Vanguard report offered the following observation:

“As of December 31, 2015, Canadian equities accounted for 3% of the global equity market. To the extent that investors choose to invest in the global market regardless of their home country, they would hold 3% of their equity portfolio in Canadian stocks. But, on average, this was not the case among Canadian investors, who collectively held 54% at year-end in 2015.”

Human Nature: Even if we know it’s important to stay consistently diversified over time, it’s hard to not second-guess your plans when an asset class has been underperforming for a while. Unfortunately, just when you’re ready to give up on it, that’s often when it comes roaring back to life. In the absence of a crystal ball, your best bet is to stay put through the unpredictable highs and the lows, but that’s easier said than done!

Rebalancing Challenges: Establishing a diversified portfolio is pretty easy. You pick a mix of asset classes that makes sense for you, and invest in one or a handful of funds or ETFs accordingly. But over time, your mix is likely to shift as various asset classes outperform others. This calls for periodic rebalancing back to your target allocations. You can rebalance by adjusting your existing portfolio, and/or using cash flows in and out to do the same. Either way, rebalancing calls for additional, tax-wise planning over time.

Achieving Diversification: Next Steps

So, what do you think? Are your investments already fully diversified across the range of Canadian and international asset classes we described in our last post [hyperlink] as well as in Chapter 4 of The Empowered Investor? Or could your portfolio use some evidence-based adjustments? Perhaps your healthy helping of Canadian stocks could stand to be trimmed. Or you may want to take a fresh look at your strategies if you’ve been favoring technology stocks, overweighting dividend stocks, or otherwise tilting your portfolio into trends instead of asset classes.

Next up, we’ll explore the third of four essential evidence-based investing components: using passive or index-based funds for diversified asset class investing. If you have questions or comments about what you’ve read so far, please reach out to us today. We love hearing from our readers!

Additional Reading:

- EBI Principal #2: Diversify Your Asset Classes, a Tulett, Matthews & Associates Podcast

- Vanguard’s framework for constructing globally diversified portfolios, March 2017

- And, as always, our own book: The Empowered Investor

More Winning Investment Principals

Investment Principal #4: Maximize Returns with Key Investment Factors

Discover how investment factors can help you maximize returns. Learn strategic factor investing to enhance your portfolio.

Investment Principal #3: Using Passive/Index Funds or ETFs

Index-based or passive asset class funds focus on how to reduce the costs and frictions involved in capturing the market’s generous expected returns over time.

Investment Principal #1: Invest in Asset Classes

Evidence suggests your portfolio’s asset class mix has a much larger impact on its variation of returns, compared to stock-picking and/or market-timing techniques.

Stay on top of your financial education

Subcribe and follow to get updates on important wealth management topics.

Connect

Visit Us

3535 St-Charles Blvd.

Suite 703

Kirkland, Quebec

H9H 5B9

Connect