commentary

2022 Market Review

A Changing Investment Landscape

It was an up-and-down year for markets—in the end, one with more down than up. The world gave financial markets a lot to process. The coronavirus pandemic eased but remained a global concern, as did the supply-chain issues that accompanied its arrival. Inflation reached a multi-decade high, and global central banks pursued a series of interest rate increases to combat rising prices. Russia’s invasion of Ukraine in February brought uncertainty about political stability and energy prices, among other worries. Investors contended with a quickly evolving investment landscape in 2022.

Fixed income investors received little safety from riskier assets, as bond prices and equities dropped in response to rate hikes.

Following a robust year for global stocks in 2021; 2022 was wrought with increased levels of uncertainty and volatility as US and Global ex Canadian stocks reached bear territory (-20% or more) in June of 2022. Canadian stocks, US stocks and international stocks dropped by -5.84%, -12.35% and -8.43% in 2022, respectively. Value served as a bright spot, outperforming growth by the largest margin in over 20 years.

It was a year that showed, once again, the difficulty of making investment decisions based on bold market predictions. 2022 highlighted the performance benefits of portfolio diversification. Having a clear investment philosophy, not only produced superior results, but also helped provide transparency, clarity and peace of mind for our clients.

For more information, please see our recent podcast:

Exhibit 1: 2022 Index Returns (in Canadian dollars)Fixed Income Cash and Equivalents +1.69% World Government Bond Index 1–5 Years -2.09% World Aggregate Credit Index 1-5 Year -6.21% Canadian Short-Term -4.05% Canadian Bond Universe -11.69% Canadian Equity Canadian Stocks (S&P/TSX Composite Index) -5.84% Canadian Value Stocks +0.50% Canadian Small Value Stocks +2.66% US Equity US Stocks (S&P 500 Index) -12.35% US Value Stocks -1.50% US Small Value Stocks -8.46% Developed International Equity International Stocks (MSCI EAFE) -8.43% International Value Stocks +1.06% International Small Value Stocks -9.00% Emerging Market Equity Emerging Market Stocks (MSCI Emerging Market) -14.47% Emerging Market Value Stocks -9.90% Emerging Markets Small Value Stocks -6.31% Real Estate investment Trusts (REITS) Global REITS -19.04% Canadian REITs -17.00% Currencies Canadian Dollar vs USD -6.58% Canadian Dollar vs Euro -0.64% Canadian Dollar vs Australian Dollar -0.17% Note: Indexes are in the endnotes of this commentary

TMA Model Portfolio Returns

The S&P 500 Index fell to a two-year low in September; at one point, the index had given back 50% of its post-pandemic rally. After the sharp drop in the first half of the year, led by technology stocks, the stock market rebounded somewhat. That came as market participants began weighing in less rate hikes going forward as inflation pressures cooled.

Despite the rally, the S&P 500 fell 18.00% in USD and 12.35% in CAD for the year. Likewise, global stock markets ended with their largest declines since the financial crisis. Global equities, as measured by the MSCI All Country World Index, fell 12.62% CAD (see Exhibit 3).

| Exhibit 2: 2022 TMA Model Portfolio Returns | |

| 30% Equity 70% Bonds | -8.35% |

| 50% Equity 50% Bonds | -7.51% |

| 60% Equity 40% Bonds | -7.11% |

| 65% Equity 35% Bonds | -6.91% |

| 75% Equity 25% Bonds | -5.82% |

| 100% Equity | -5.61% |

| Note: Actual client portfolios may differ due to slightly different asset allocations. These returns are before TMA management fees. |

2022 World Stock market Performance

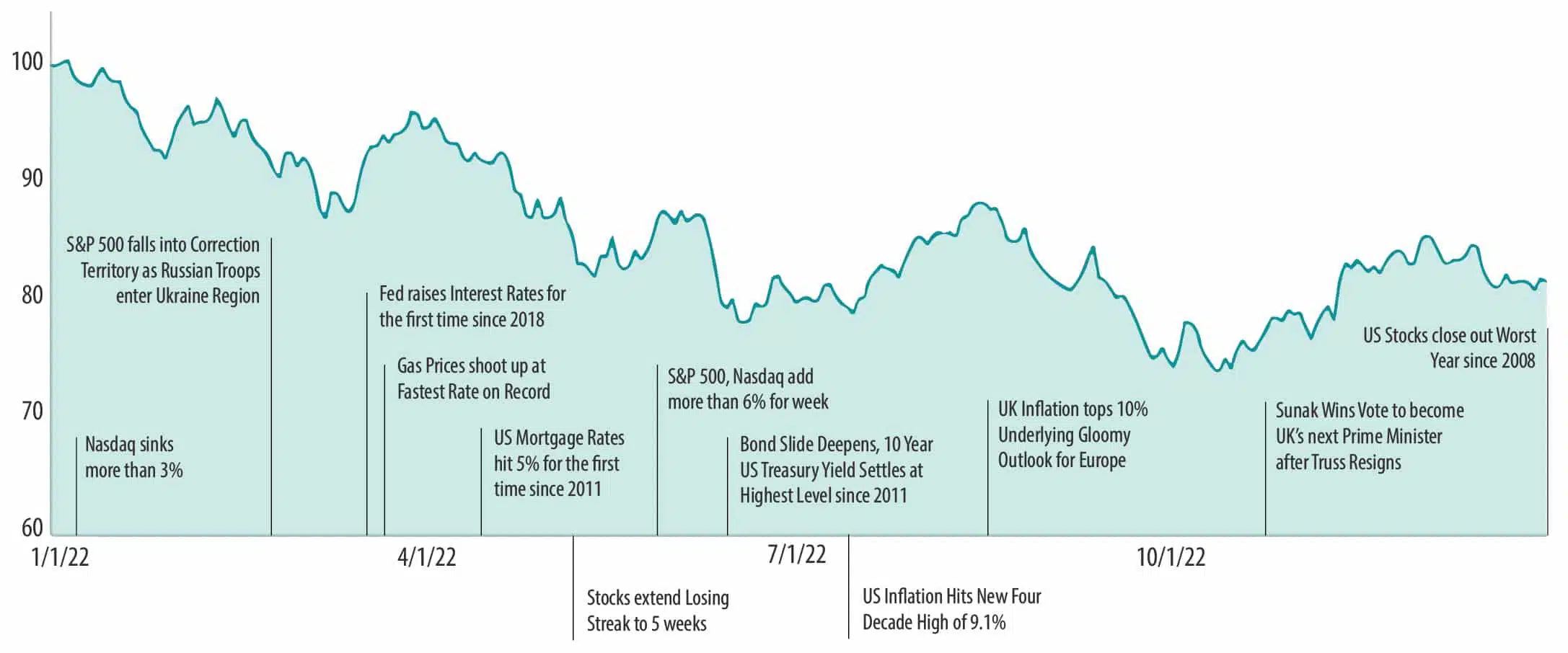

Exhibit 3 presents select headlines from 2022 alongside movements of the global stock market, as measured by the MSCI All Country World Index. These headlines should not be viewed as determinants of the market’s direction, but as examples of events that may have tested investor discipline during the year.

As long-term investors, we tune out the daily headlines and commit to a long-term investment approach that is unaffected by the news events and forecasts.

Exhibit 3: 2022 World Stock Market Performance – Late Rebound Not Enough for Markets

MSCI All Country World Index with select 2022 headlines

Graph Source: In USD. MSCI All Country World Index, net dividends. MSCI data © MSCI 2023, all rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Headlines are sourced from various publicly available news outlets and are provided for context, not to explain the market’s behavior.

Inflation & Recession Fears on the Rise

Throughout 2022, global central banks continued to fight surging inflation by increasing interest rates, causing global stock and bond markets to falter. Higher interest rates inevitably dampen inflation, however, it can also push economies into slowdowns (or recessions). Global investors are anticipating economic growth to slow and possibly even to contract a little, as the word “recession” was mentioned often in the financial media.

If the central banks’ aggressive actions pay off, we should see inflation continue its gradual move downwards. While no one can accurately predict what central banks will do, the market expects slowing rate hikes, with pauses and even possible declines in late 2023 or 2024.

Since June 2022, Canadian and US inflation figures have been on a downward trajectory, leading to a late-2022 stock market rally of 4% to 8%, with some anticipating a soft landing or the possibility of a milder recession.

Historically, recessions are near-impossible to predict (although easy to spot after the fact) and have occurred every 3 to 5 years. Each recession is unique, and has a different set of circumstances and economic backdrops with varying degrees or severity, duration, and recovery patterns.

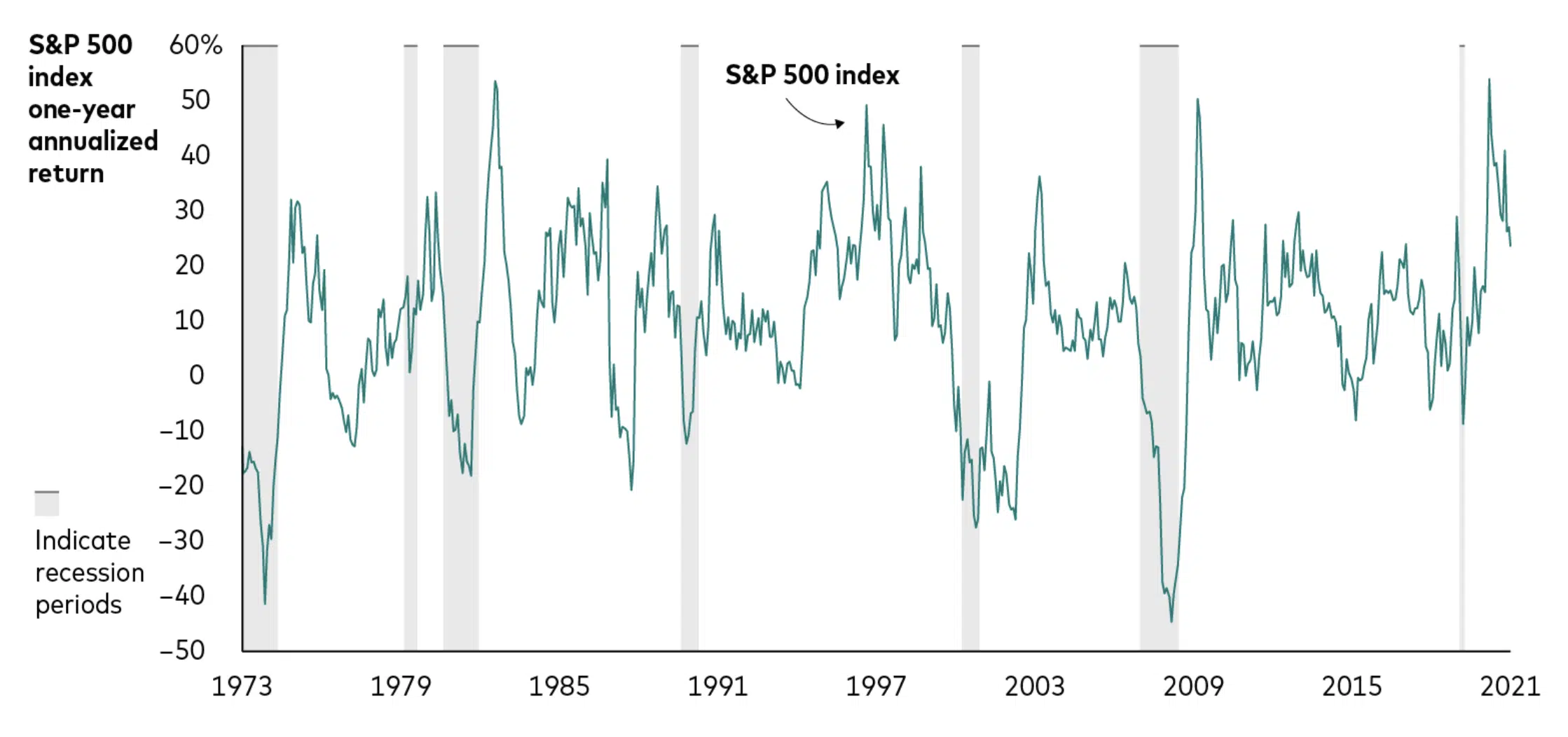

Exhibit 4 (below) illustrates the one-year annualized percentage return of the Standard & Poor’s 500 Index from 1973 to 2021, including its performance during the most recent seven recessions, as defined by the National Bureau of Economic Research (NBER). The seven recessions are represented by the grey bars. In all cases, the stock market began to recover even as the economy continued to shrink.

Exhibit 4: Equity performance and recessions

Stock recoveries often begin soon after recessions commence. In fact, in all cases, the market began to recover even as the economy continued to shrink. Markets tend to rebound when things feel the worst, recovering when economic data is the most negative.

The markets are forward thinking and looking. This is an incredibly important observation as many investors make statements like “I will invest in stocks when I see positive things happening.” Unfortunately, that “wait and see” strategy has proven to always be too late as some of the best market gains will have already materialized.

We do not know how long any recession may last or how long equity market recoveries may take. Indeed, official declarations of recessions are backward-looking. A recession can end before it has been declared, reflecting the challenge economists face in assessing the level of growth in real time.

Whether the United States, Canada, or any other country or region is in a recession or not, investors should avoid overreacting to the latest economic news and stick with well-constructed, long-term investment plans. There is no evidence that efforts to time the markets reward investors. Quite the opposite, in fact.

For more information, please see our recent podcasts on rising market volatility and inflation:

Bonds Stumble in 2022

Some may view fixed income as a haven for investors, expecting bonds to rise in value when stocks fall. However, this was not the case in 2022. The global bond market experienced one of its worst years of performance in decades, as bond prices fell in response to rising rates. Global bonds (as measured by the Bloomberg Global Aggregate Index, CAD) dropped -11.53% in 2022.

The journey from lower to higher rates produce negative total bond returns, over the short-term. However, rising interest rates are ultimately good for investors, as they generally lead to higher bond yields and higher returns for investors going forward.

We advocate a long-term approach to investing. As such, most of our clients will benefit from higher yields and enjoy higher bond returns down the road. We also overweight shorter-term fixed income allocations which was also beneficial for our clients as they were less sensitive than longer-dated bonds to rising interest rates.

Interest rates are likely to stay elevated even as inflation moderates, likely ending many years of negative real (inflation-adjusted) rates in fixed income. We are on the verge of entering a period of positive real rates, strengthening the case for fixed income on go-forward basis. Moreover, when the current economic uncertainty subsides, fixed income will likely resume its role as a buffer for equities in investor portfolios.

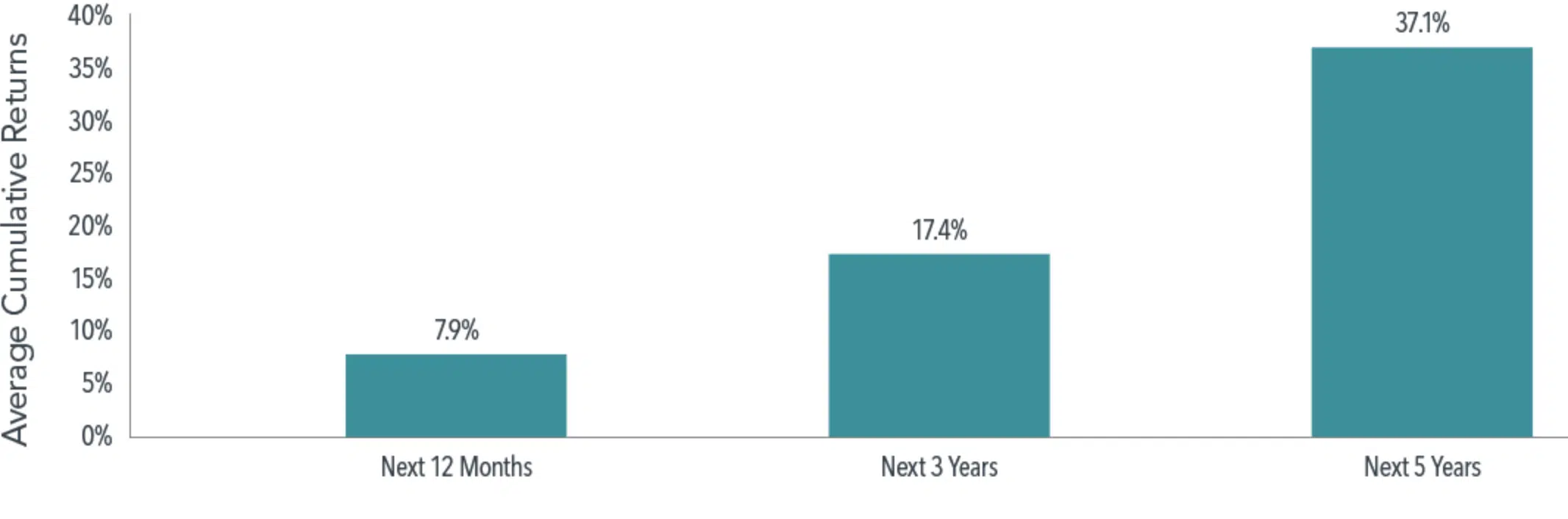

If history is any indication, the patience of balanced investors will pay off: over the past half-century, the traditional 60% equity, 40% fixed income portfolio has never had a three-year period with negative returns for both stocks and bonds. Following a drop of 10% or more since 1926, returns have been strong in the subsequent one-, three-, and five-year periods:

Exhibit 5: A Case for Optimism

Performance of a 60% equity, 40% fixed income portfolio following a decline of 10% or more

60/40 portfolio measured by: 60% S&P 500 Index, 40% 5-year US Treasury notes, in USD. January 1926—December 2022.

Investing in a well-diversified portfolio that suits your long-term objectives is the recipe for continued financial success.

For more information, please see our recent podcasts on rising interest rates and fixed income:

The Value Pendulum Swings into Favour

While markets were down as a whole, value stocks were a bright spot for investors in 2022. Value stocks, those with a low price relative to a measure like a company’s book value (or earnings), outperformed pricier growth stocks by 21.06% in 2022. This outperformance marks the highest margin since 2000.

The 3-year period ending June 2020 was one of the worst on record for the value premium, capped off by a surge in demand for technology and “stay at home” stocks in mid-2020, as global COVID-19 lockdowns were implemented. Since this period, value has outperformed growth by 8.35% per year.

Value’s recent turnaround has rewarded investors who remained disciplined following its recent period of relative underperformance. This is a reminder on how quickly premiums can show up, along with the benefits of staying the course.

In 2022, TMA client portfolios have experienced strong relative equity returns (See Exhibit 6 and 7), as value stocks outperformed broad indices, as well as growth stocks. As part of our long-term investment philosophy, we have held long-term overweight positions to value and small value companies by way of broadly diversified Dimensional equity strategies.

Exhibit 6: DFA Core Strategy vs Broad BenchmarkDFA Core Strategy Broad Benchmark Outperformance Canadian equities +1.03% -5.84% +6.87% US equities -8.89% -12.35% +3.46% International equities -9.51% -10.36% +0.85% Canadian equities outperformance measured by DFA Canadian Core Fund (F) minus S&P/TSX Composite Index. US equities outperformance measured by DFA US Core Fund (F) minus S&P 500 Index. International equities outperformance measured by DFA International Core Fund (F) minus MSCI EAFE + EM Index. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio.

Exhibit 7: DFA Vector Strategy vs Broad BenchmarkExhibit 7: DFA Vector Strategy vs Broad Benchmark DFA Core Strategy Broad Benchmark Outperformance Canadian equities +3.29% -5.84% +9.13% US equities -3.59% -12.35% +8.76% International equities -7.71% -10.36% +2.65% Canadian equities outperformance measured by DFA Canadian Core Fund (F) minus S&P/TSX Composite Index. US equities outperformance measured by DFA US Core Fund (F) minus S&P 500 Index. International equities outperformance measured by DFA International Core Fund (F) minus MSCI EAFE + EM Index. Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio.

2022 TMA Model Portfolio Returns

Exhibit 8: TMA Model Portfolio Returns (as of December 31st, 2022)

The table below lists various TMA portfolio allocations using Dimensional asset class strategies and their respective annual returns from 2006 to 2022.

2022 and Calendar Year TMA Model Portfolio Returns

| Date | 30% Equity 70% Bonds | 50% Equity 50% Bonds | 60% Equity 40% Bonds | 65% Equity 35% Bonds | 75% Equity 25% Bonds | 100% Equity |

|---|---|---|---|---|---|---|

| 2006 | 7.87% | 11.43% | 13.22% | 14.11% | 15.90% | 20.44% |

| 2007 | 1.54% | -0.26% | -1.15% | -1.60% | -2.49% | -4.64% |

| 2008 | -7.01% | -13.99% | -17.35% | -19.00% | -22.23% | -29.96% |

| 2009 | 10.40% | 14.53% | 16.59% | 17.62% | 19.67% | 24.90% |

| 2010 | 8.52% | 10.23% | 11.05% | 11.45% | 12.05% | 14.17% |

| 2011 | 1.96% | -1.12% | -2.69% | -3.46% | -5.34% | -9.05% |

| 2012 | 7.65% | 9.13% | 9.86% | 10.22% | 10.94% | 12.66% |

| 2013 | 6.83% | 12.18% | 14.94% | 16.32% | 19.38% | 26.27% |

| 2014 | 6.59% | 7.37% | 7.74% | 7.95% | 7.93% | 9.19% |

| 2015 | 3.18% | 4.08% | 4.51% | 4.73% | 5.12% | 6.17% |

| 2016 | 6.09% | 8.24% | 9.31% | 9.85% | 10.49% | 13.54% |

| 2017 | 5.55% | 7.80% | 8.94% | 9.51% | 10.40% | 13.59% |

| 2018 | -1.87% | -3.38% | -4.14% | -4.53% | -5.27% | -7.30% |

| 2019 | 9.49% | 11.95% | 13.19% | 13.81% | 14.63% | 18.22% |

| 2020 | 5.16% | 5.89% | 6.13% | 6.22% | 5.98% | 6.24% |

| 2021 | 5.13% | 9.60% | 11.87% | 13.03% | 15.53% | 21.32% |

| 2022 | -8.35% | -7.51% | -7.11% | -6.91% | -5.82% | -5.61% |

| Summary Statistics (January 1st 2006 to Dec 31st 2022) | ||||||

| 1-Year Return | -8.35% | -7.51% | -7.11% | -6.91% | -5.82% | -5.61% |

| 3-Year Return | 0.44% | 2.39% | 3.32% | 3.78% | 4.86% | 6.73% |

| 5-Year Return | 1.71% | 3.03% | 3.66% | 3.96% | 4.60% | 5.90% |

| 10-Year Return | 3.66% | 5.44% | 6.31% | 6.75% | 7.58% | 9.66% |

| 17-Year Return | 3.90% | 4.86% | 5.03% | 5.52% | 5.90% | 6.87% |

| Growth of $1 | $1.92 | $2.21 | $2.36 | $2.44 | $2.57 | $2.95 |

| Standard Deviation | 4.64% | 6.72% | 7.84% | 8.41% | 9.50% | 12.55% |

| Actual client portfolios may differ due to slightly different asset allocations. Model portfolio returns are before TMA management fees but after Dimensional Fund Advisor management fees. (1): As of January 1st 2010, TMA Model Portfolios include DFA Investment Grade Fixed Income (F). (2) As of January 1st 2016, TMA Model Portfolios include DFA Targeted Credit Fund (F). Note: Complete TMA model portfolio allocations and holdings can be found in the endnotes of this commentary. |

Major Investment Themes in 2022:

- Avoiding speculation and not chasing flashy trends protected portfolios

- Valuations do matter

In 2020 and the early months of 2021, many stock market participants were clamoring to invest in high profile “asset du jour” – high growth/low-to-no profit companies, cryptocurrencies, meme stocks and other speculative high-flying sectors of the market.

In the later months of 2021 and throughout 2022 these speculative assets came crashing down to earth. Investors looking for quick and oversized returns, had piled into these securities at sky-high valuations. However, in 2022 many speculative bubbles burst, and investors have seen devastating returns. Like past market periods, capital invested in these overhyped areas maybe lost forever. Many of these investments have lost 70 to 90% of their peak levels.

Exhibit 8 (below) shows example of select high profile, low profit and speculative investments and their shift from euphoria and excess, to downturn in 2022.

Exhibit 9: Performance of Select Speculative, Expensive & “Disruptive Company” Securities2020 2021 2022 Zoom 396% -45% -63% Paypal 117% -19% -62% Peloton 434% -76% -78% Robinhood (as of IPO July 29th, 2021) - -49% -54% ARK Innovators ETF 153% -23% -67% Beyond Meat 66% -48% -81% Lightspeed (CAD) 149% -43% -62% Plug 973% -17% -56% Quantum Scape (as of IPO November 17th, 2020) - -73% -74% Ballard Power 226% -46% -62% GameStop 220% 687% -52% Coinbase (as of IPO April 14th, 2021) - -17% -86% Bitcoin 289% 61% -65% Performance in USD, unless otherwise indicated.

Valuations matter: Even the profitable FAANG stocks (Facebook, Amazon, Apple, Netflix, and Google) tumbled in 2022 as valuations had reached exorbitant levels. The FAANGs collectively underperformed the broad US market by 25% last year.

Exhibit 10: Performance of Well-Known Large Tech Companies2020 2021 2022 NASDAQ 100 46% 34% -33% Shopify (CAD) 178% 21% -73% Tesla 743% 50% -65% Netflix 67% 11% -51% Facebook 33% 23% -64% Amazon 76% 2% -49% Apple 82% 35% -26% Google 31 % 65% -39% Performance in USD, unless otherwise indicated.

The reversal seen in many sectors of the market is a reminder that investors should be cautious about assuming past returns will continue. Companies with track records of strong stock returns does not always translate into above average future returns.

Attempting to invest in a few hot stocks —like focusing on any small number of holdings—can expose investors to substantial risk. Even if you manage to find a few winners, sound research and data suggest that good luck is unlikely to repeat throughout a lifetime of investing.

Avoiding investment collapses, speculative blow-ups, and high-flying company meltdowns is critical to protecting your capital and is a key principle to long-term investment success.

For more information, please see our recent podcast on chasing stock market performance:

Developing an Investment Plan – You Can Stick With

There is no way to know where markets may be headed, and it can be hard to imagine an upturn when prices have fallen or when there is trepidation about the direction of the economy. But history argues for persistence and patience. With the yield curve inverted, some economists are saying a recession is inevitable, if one has not already begun. But history shows that across the two years that follow a recession’s onset, equities have a track record of positive performance, on average. This is an important lesson on the forward-looking nature of markets, highlighting how current prices reflect market participants’ collective expectations for the future. Likewise, equity returns following sharp declines have, on average, been positive over one-year, three-year, and five-year periods.

A look back at recent history makes a case for sticking with a plan. Handsome rebounds after steep declines can help put investors in position to capture the long-term benefits the markets offer. Those who sold their stockholdings during the dot-com crash in the early 2000s would not have been in position to enjoy the equity recovery that eventually followed. Similarly, those abandoning a plan early in the 2008–09 financial crisis, or in March of 2020 as COVID fears spread, would not have benefited from the subsequent rallies. As we look at prices that in some cases are well off their highs, it is helpful to keep history in mind entering 2023. That’s the definition of thinking of investing for the long term.

2022 – Lessons for Long-Term Investment Success

#1. Have and commit to a clear investment philosophy

Our investment philosophy is an investment approach that is built on a series of investment principles and supported by evidence, data, and results. It keeps us grounded, stops us from chasing, allows us to capture the returns available in an asset class, and reinforces patience and playing the long game. An additional client benefit is that it reduces anxiety, adds transparency and clarity, and increases peace of mind.

#2. Avoid pitfalls and do not chase investment fads

Discipline and commitment to the investment process pays off. Steering clear of investment pitfalls, and not chasing performance and fads was critical to navigating choppy waters in 2022. Getting trapped in one pitfall can often set back an investor for many years.

We remain diligent and realize that the future almost always remains or “feels” uncertain and it is paramount that we avoid all forms of speculation. The best strategy to endure market uncertainty is to follow a long-term investment plan by staying invested, diversified, and rebalancing in a timely manner across different regions and asset classes.

#3. Do not rely on experts’ forecasts

Remember that markets are unpredictable and do not always react the way the experts predict. Unfortunately, investors regularly overemphasize forecasts delivered by confident-sounding financial gurus and market prognosticators. In today’s noise driven news & investing world, there is never a shortage of predictions. We will stay clear and stay the course.

#4. Pay attention to valuations – they matter

The price you pay for any financial asset is the driving force of your expected investment success or expected return (or failure). It is important to remain grounded, and avoid speculative bubbles, or the “asset du jour”, as buying at sky-high prices, rarely work in the long run. We have and will hold tilts towards value investing and this will help ensure that we and you stay clear of overinflated prices.

When asset prices drop; like stocks and bonds did in 2022, expected “future” returns turn higher. Investors with the ability to save and add money to portfolios, should embrace volatility, as this enables them to invest more when valuations are lower and expected returns are higher. Investors who are not able to add funds, should stay the course and use the opportunity to rebalance by investing more in the lower priced asset classes (we do that for all clients). These actions present the opportunity to “buy low.”

All the best for 2023

We hope that you find this year-end commentary helpful and informative. We look forward to seeing and speaking with you soon. In the meantime, should you have any questions, please do not hesitate to contact us. We are always here to answer your questions and address your needs.

On behalf of all of us at Tulett, Matthews & Associates, we wish you a happy and healthy 2023.

Endnotes:

Exhibit 1:

FTSE Canada 30-day T-Bill, FTSE World Government Bond Index 1–5 Years, Bloomberg Global Aggregate Credit Bond Index 1-5 Years (hedged), FTSE TMX Canada Short-Term Bond Index, FTSE Canada Universe Bond Index, S&P/TSX Composite Index, MSCI Canada Value Index, MSCI Canada Small Value Index (net div.), S&P 500 Index, Russell 3000 Value Index, Russell 2000 Value Index, MSCI EAFE Index (net div.), MSCI EAFE Value Index (net div.), MSCI EAFE Small Value Index (net div.), MSCI Emerging Market Index (net div.), MSCI Emerging Markets Value Index (net div.), MSCI Emerging Markets Small Value Index (net div.), S&P/TSX Capped REIT Index and the S&P Global REIT Index (net dividend). Indices are not available for direct investment and performance does not reflect expenses of an actual portfolio.

Exhibit 8:

100EQ/0FI: Constructed under CAD

Period 1: From 7/2005 To 12/2022 Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 33.3400% DFA Canada International Core Equity Fund Class F 33.3300% DFA Canada US Core Equity Fund Class F 33.3300%

75EQ/25FI Constructed under CAD

Period 1: From 7/2005 (Earliest) To 12/2015 Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 25.00% DFA Canada Five-Year Global Fixed Income Fund Class F 25.00% DFA Canada International Core Equity Fund Class F 25.00% DFA Canada US Core Equity Fund Class F 25.00%

Period 2: From 1/2016 To 12/2022 (Latest) Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 25.00% DFA Canada Five-Year Global Fixed Income Fund Class F 12.500% DFA Canada International Core Equity Fund Class F 25.00% DFA Canada US Core Equity Fund Class F 25.00% DFA Canada Global Targeted Credit Fund Class F 12.500%

65EQ/35FI Constructed under CAD

Period 1: From 7/2005 (Earliest) To 12/2009 Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 21.6700% DFA Canada Five-Year Global Fixed Income Fund Class F 35.00% DFA Canada International Core Equity Fund Class F 21.6600% DFA Canada US Core Equity Fund Class F 21.6700%

Period 2: From 1/2010 To 12/2015 Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 21.6700% DFA Canada Five-Year Global Fixed Income Fund Class F 23.4500% DFA Canada Global Investment Grade Fixed Income Fund – Class F 11.5500% DFA Canada International Core Equity Fund Class F 21.6600% DFA Canada US Core Equity Fund Class F 21.6700%

Period 3: From 1/2016 To 12/2022 (Latest) Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 21.6700% DFA Canada Five-Year Global Fixed Income Fund Class F 11.6700% DFA Canada Global Investment Grade Fixed Income Fund – Class F 11.6600% DFA Canada International Core Equity Fund Class F 21.6600% DFA Canada US Core Equity Fund Class F 21.6700% DFA Canada Global Targeted Credit Fund Class F 11.6700%

60EQ/40FI Constructed under CAD

Period 1: From 7/2005 (Earliest) To 12/2009 Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 20.0% DFA Canada Five-Year Global Fixed Income Fund Class F 40.0% DFA Canada International Core Equity Fund Class F 20.0% DFA Canada US Core Equity Fund Class F 20.0%

Period 2: From 1/2010 To 12/2015 Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 20.0% DFA Canada Five-Year Global Fixed Income Fund Class F 27.00% DFA Canada Global Investment Grade Fixed Income Fund – Class F 13.00% DFA Canada International Core Equity Fund Class F 20.0% DFA Canada US Core Equity Fund Class F 20.0%

Period 3: From 1/2016 To 12/2022 (Latest) Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 20.0% DFA Canada Five-Year Global Fixed Income Fund Class F 13.3400% DFA Canada Global Investment Grade Fixed Income Fund – Class F 13.3300% DFA Canada International Core Equity Fund Class F 20.0% DFA Canada US Core Equity Fund Class F 20.0% DFA Canada Global Targeted Credit Fund Class F 13.3300%

50EQ/50FI Constructed under CAD

Period 1: From 7/2005 To 12/2009 Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 16.6700% DFA Canada Five-Year Global Fixed Income Fund Class F 50.0% DFA Canada International Core Equity Fund Class F 16.6600% DFA Canada US Core Equity Fund Class F 16.6700%

Period 2: From 1/2010 To 12/2015 Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 16.6700% DFA Canada Five-Year Global Fixed Income Fund Class F 33.500% DFA Canada Global Investment Grade Fixed Income Fund – Class F 16.500% DFA Canada International Core Equity Fund Class F 16.6600% DFA Canada US Core Equity Fund Class F 16.6700%

Period 3: From 1/2016 To 12/2022 (Latest) Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 16.6700% DFA Canada Five-Year Global Fixed Income Fund Class F 16.6700% DFA Canada Global Investment Grade Fixed Income Fund – Class F 16.6600% DFA Canada International Core Equity Fund Class F 16.6600% DFA Canada US Core Equity Fund Class F 16.6700% DFA Canada Global Targeted Credit Fund Class F 16.6700%

30EQ/70FI Constructed under CAD

Period 1: From 7/2005 (Earliest) To 12/2009 Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 10.0% DFA Canada Five-Year Global Fixed Income Fund Class F 70.0% DFA Canada International Core Equity Fund Class F 10.0% DFA Canada US Core Equity Fund Class F 10.0%

Period 2: From 1/2010 To 12/2015 Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 10.0% DFA Canada Five-Year Global Fixed Income Fund Class F 47.00% DFA Canada Global Investment Grade Fixed Income Fund – Class F 23.00% DFA Canada International Core Equity Fund Class F 10.0% DFA Canada US Core Equity Fund Class F 10.0%

Period 3: From 1/2016 To 12/2022 (Latest) Rebalance: Per 3 Months DFA Canada Canadian Core Equity Fund Class F 10.0% DFA Canada Five-Year Global Fixed Income Fund Class F 23.3400% DFA Canada Global Investment Grade Fixed Income Fund – Class F 23.3300% DFA Canada International Core Equity Fund Class F 10.0% DFA Canada US Core Equity Fund Class F 10.0% DFA Canada Global Targeted Credit Fund Class F 23.3300%

Connect

Visit Us

3535 St-Charles Blvd.

Suite 703

Kirkland, Quebec

H9H 5B9

Connect