Keith Matthews

Partner & Portfolio Manager

Playing the Long Game: Evidence-Based Investing (Part 2)

Global Small and Value Company Stock Returns

In Part 1 of our series on evidence-based investing, we examined the importance of asset allocation and regional exposure in a diversified portfolio. We compared Canadian, US, and international equities over different ten-year periods from the past 20 years before analyzing their performance over the entire 20-year period. The various asset classes performed differently over each period, and we cautioned readers against jumping from one asset class to another in order to try to capitalize on short-term market movements. Chasing the latest “flavour of the month” or even for that matter the “flavour of the decade” has proven to be a tempting trap for countless investors over the years. That is why we should always prioritize a disciplined, long-term approach to investing; one that not only provides some added perspective, but helps us to achieve our goals as well.

We’ll now take a look at the roles played by investment style and factor exposures. We include exposure to small and value companies in our portfolio because evidence shows that they outperform large and growth companies over long investment periods.

We begin by comparing small company performance relative to large company performance through the lenses of the last ten years, the decade prior, and the last 20 years.

Small Company Performance

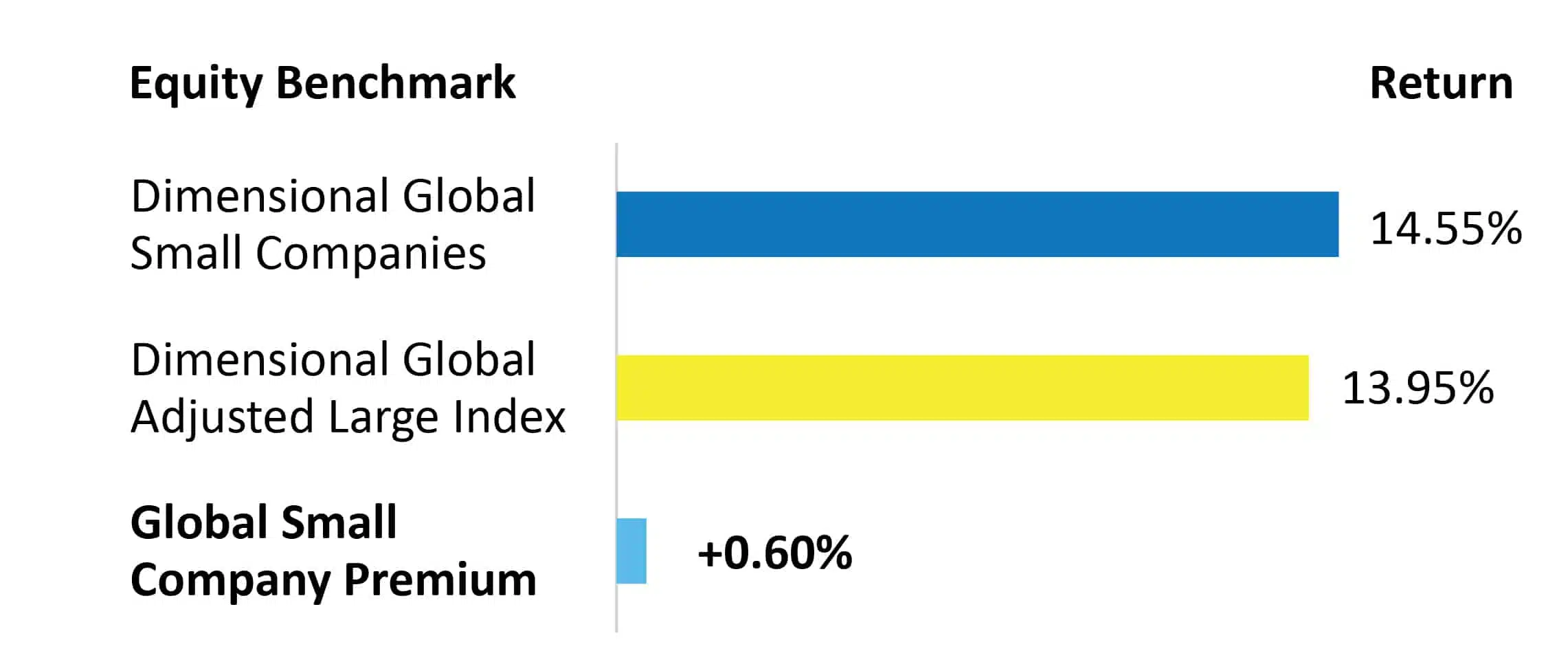

Benchmark 10 year returns as of June 30th, 2019 (CAD)

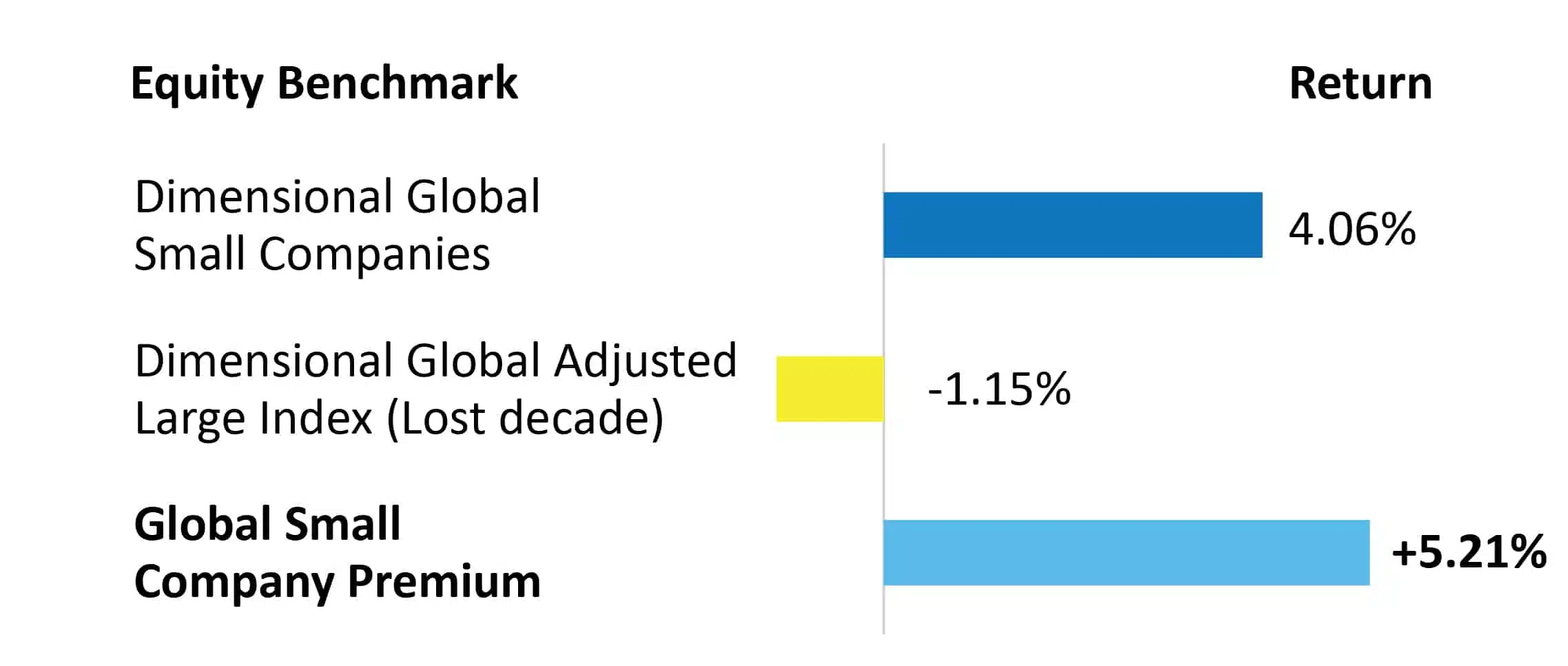

Benchmark 10 year returns as of June 30th, 2009 (CAD)

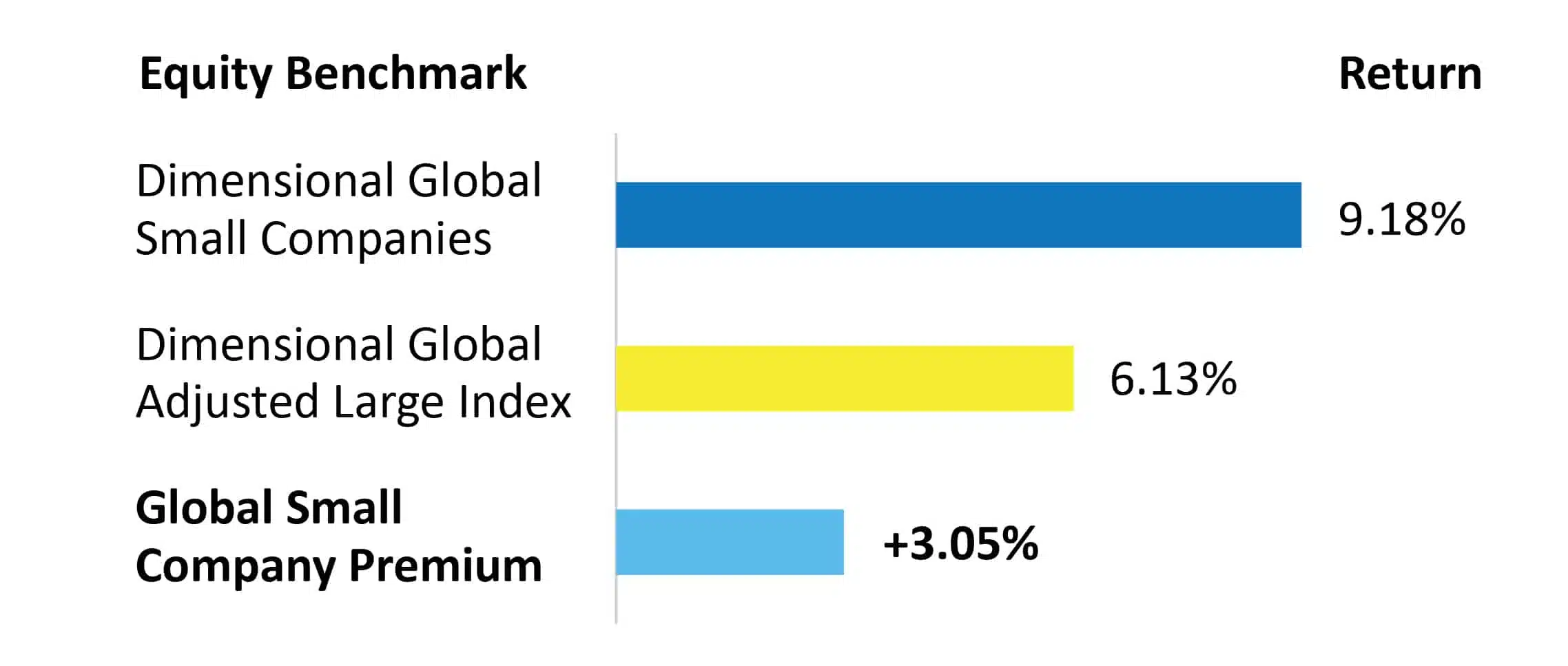

Benchmark 20 year returns as of June 30th, 2019 (CAD)

Global small company performance outpaced global large company performance over all three periods.

Historically however, small companies have underperformed large companies 24%, 27%, 13% and 7% of the time over a ten-year period for Canadian, US, International and Emerging markets respectively [popup_trigger id=”244273″ tag=”text”](see exhibit #2)[/popup_trigger]

Value Company Performance

Now let’s look at value company performance relative to growth company performance through the same multi-year periods.

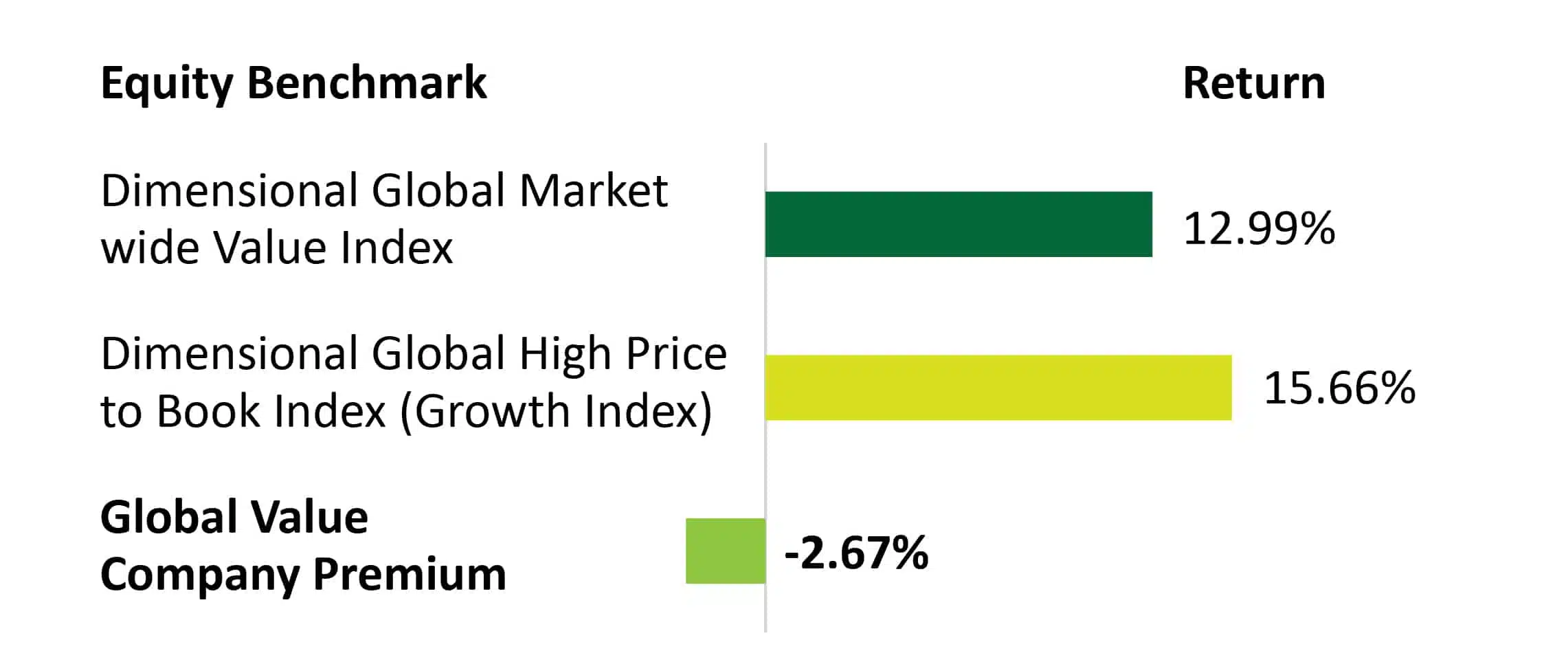

Benchmark 10 year returns as of June 30th, 2019 (CAD)

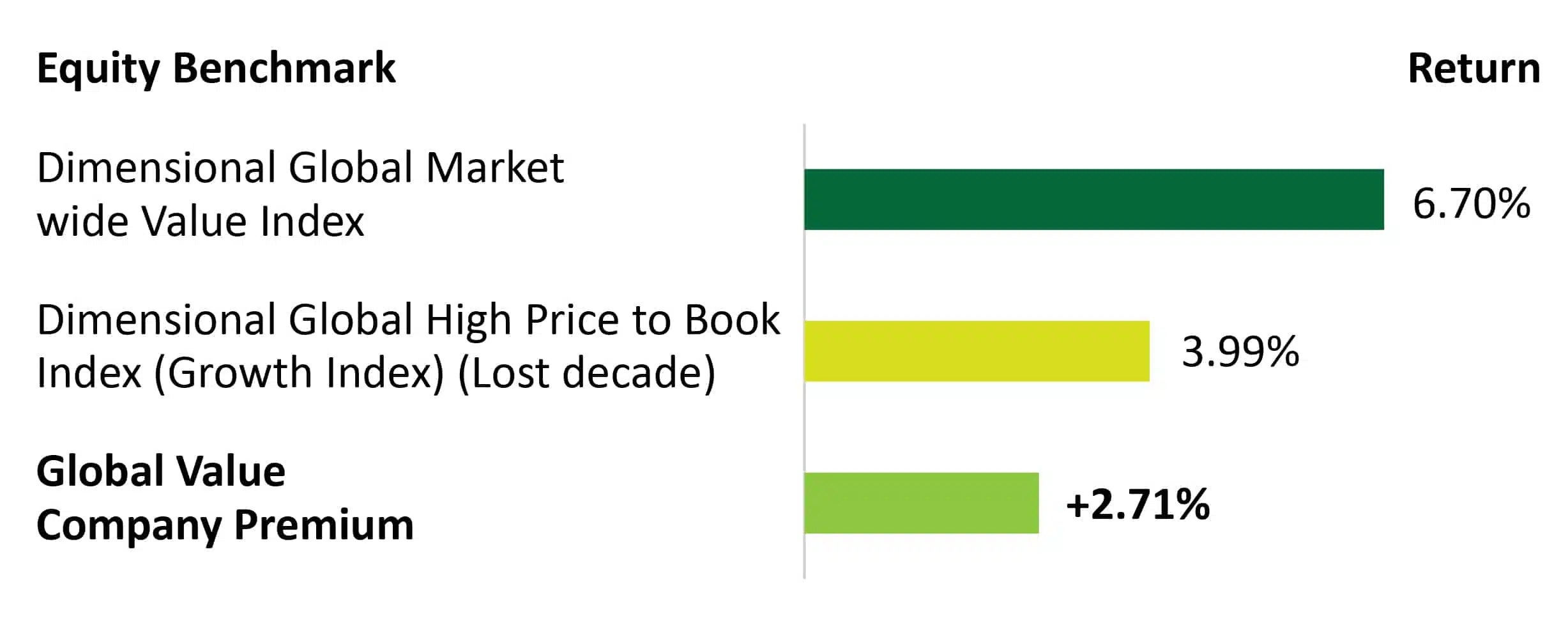

Value underperformed versus growth by -2.67%. In the prior decade, however, we saw value outperform growth by a magnitude of +7.28%.

Benchmark 10 year returns as of June 30th, 2009 (CAD)

Benchmark 20 year returns as of June 30th, 2019 (CAD)

Even though value company performance lagged growth company performance between 2009-2019, value companies still beat growth companies over the 20-year period between 1999-2019. Value’s recent weak performance is no reason to doubt the premium or the process. In fact, value companies have underperformed growth companies 8%, 17%, 2% and 18% of the time over a ten-year period for Canadian, US, International and Emerging markets respectively. [popup_trigger id=”244275″ tag=”text”](see exhibit #3)[/popup_trigger]

Executing your factor-based investing strategy

Any diversified portfolio can capture the factors by investing in Canadian, US, international, and/or emerging market stocks and then including the company value, size, and profitability factors in its allocations.

When capturing factor exposure, remember to:

- Invest in a diversified basket of securities rather than choosing a few companies that have value, small company, or high profitability characteristics.

- Invest for the long haul and stay the course. Value and small companies will go in and out of favour. Capturing these factors requires discipline and a commitment of 10 years or more.

- Combine the profitability factor with your value and small company exposures to maximize returns.

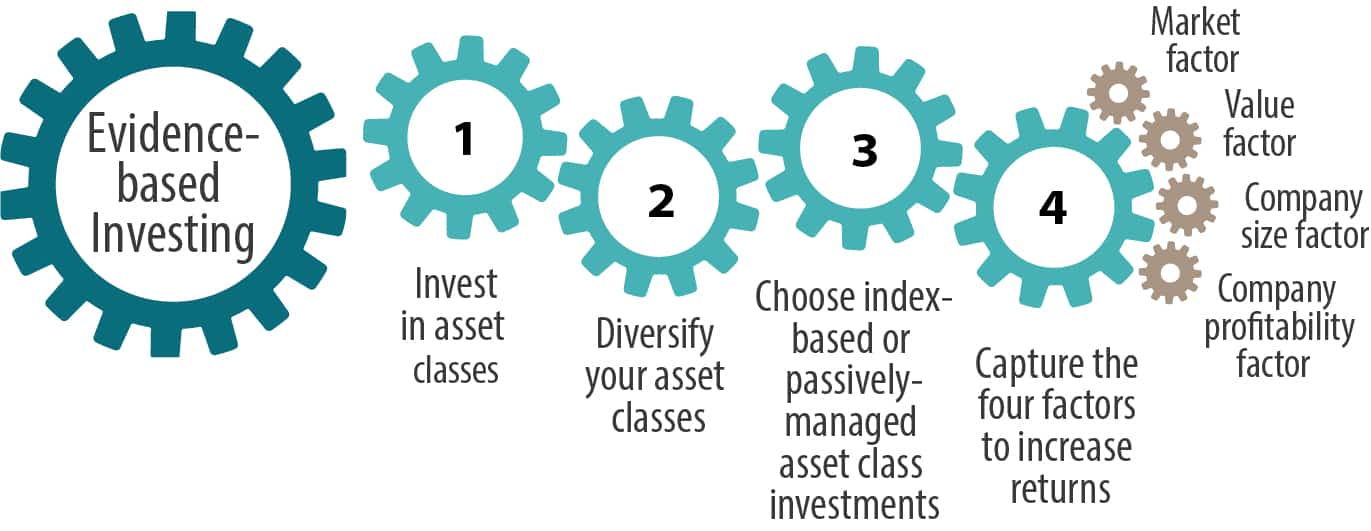

Evidence-based investing

In order to reap the benefits of factor-based investing, investors must be able to live with the fact that different factors (like asset classes) move in and out of favour over time. Instead of trying to time the market based on the latest flavour of the month, investors should adhere to their philosophy and principles to achieve their objectives. Jumping from one factor to another is risky behaviour that can have a detrimental effect on the overall health of your portfolio.

Diversifying your asset classes and capturing factors to increase returns are two crucial aspects of evidence-based investing:

- Invest in asset classes

- Diversify your asset classes

- Choose index-based or passively managed asset class investments

- Capture factors to increase returns

Evidence-based investing will grow and protect your capital over the long term. Emotional investing leads people to make the wrong decisions at the wrong times. By using strategies based on evidence, you not only benefit from the increased probability of stronger long-term returns, but you also protect yourself from the dangers of emotional investing and short-term thinking.