Copyright Behavior Gap 2015

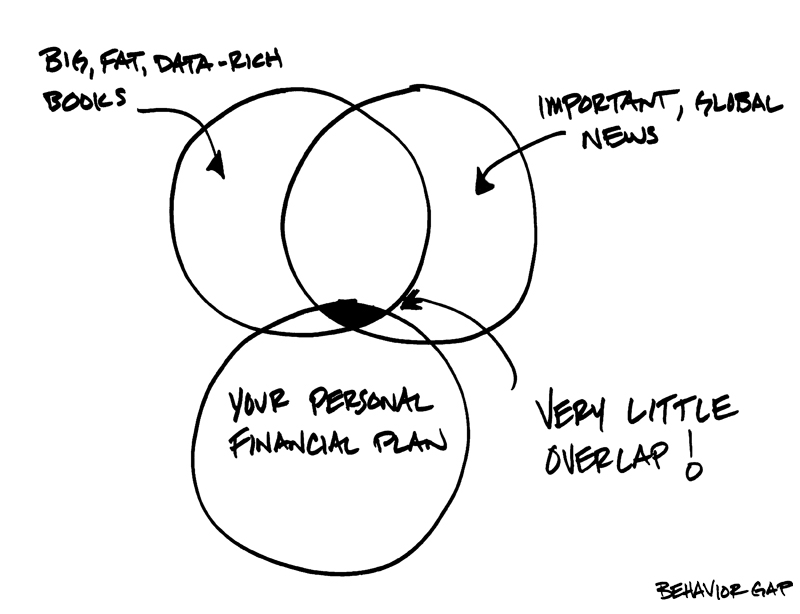

Using nothing but the facts and a Sharpie, Mr. Richards sets himself apart from many others in financial media. While it is important that we keep ourselves informed of economic events around the world, we would like to remind you that the media is in the business of reporting news; not investment advisory.

To begin with, it is important to note that Greece only accounts for approximately 3.3% of the Eurozone population and 1.8% of its GDP, and is therefore a minor player in the EU. For a complete list of European Union and Eurozone countries, see the table below.

Eurozone Members (Countries Who Use the Euro):

| Austria | Belgium | Cyprus | Estonia |

| Finland | France | Germany | Greece |

| Ireland | Italy | Latvia | Lithuania |

| Luxembourg | Malta | The Netherlands | Portugal |

| Slovakia | Slovenia | Spain |

European Union Members Who Do not Use the Euro:

| Bulgaria | Croatia | Czech Republic | Denmark |

| Hungary | Poland | Romania | Sweden |

| United Kingdom |

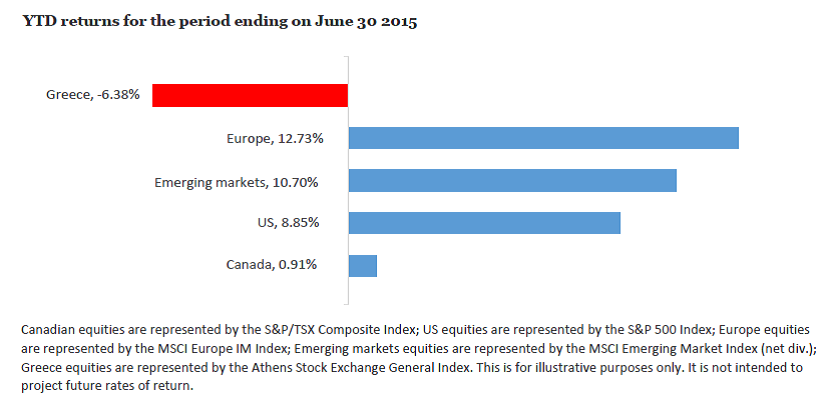

While we would never understate the impact of recent events on the lives of Greek citizens, we would like to provide you with some perspective on how the recent uncertainty might affect your portfolio. What changes will we be making to our client portfolios in response to the situation in Greece? None whatsoever. Events like these are bound to happen; they are one of the reasons we have an investment philosophy and investment policy statement. Some might say that Greece’s troubles have rendered the European stock market too risky to invest in; others will counter that now is the time to buy to take advantage of added volatility. We will not listen to either. We have never practiced market timing or aggressive tactical portfolio shifts and we aren’t about to start now. Somewhat ironically, European equities have boomed despite everything that has happened in Greece. In fact, the MSCI Europe IMI Index has returned 12.73% for the 6 months ending June 30, making Europe one of the best performing regions for Canadian investors of 2015 thus far (see chart below). Our client portfolios have benefited greatly from exposure to international equities. By staying disciplined and committed to our investment strategy, we ignore the hysteria and increase our chances of achieving a better long-term investment outcome.

When constructing portfolios, we ensure that unexpected geopolitical risks are mitigated with proper diversification. For instance, our typical 60% equity/ 40% bonds portfolio has only a 0.02% allocation to Greece. Yes, a Greek default would have led neighbouring economies within the Eurozone to experience adverse effects. Yet even with that, our 60/40 portfolio has a limited exposure of 4.17% to the Eurozone member states. World markets would most likely be affected as well, yet your portfolio construction and investment philosophy would help you make it through such an event.

Click here to see the TMA 100% Equity Allocation by Country (as of December 31, 2014)

No one can predict the future. We can only be certain that unpredictable events (be they negative or positive) are always somewhere around the corner. (We could just as easily have used this article to talk about China’s falling stock market and our advice would have remained the same.) It is important to never make any decisions based on market noise and media headlines. The best strategy, which we will continue to apply, is to follow your long-term investment plan by staying invested, diversified, and rebalancing in a timely manner across different regions and asset classes.