Keith Matthews

Partner & Portfolio Manager

Inverted yield curve:

What is it and what are the implications for your investments?

Last week’s US yield curve inversion led to jittery equity markets. It captured a lot of financial press and attention too.

So, what’s all the noise about? This brief note will provide you with some clarity and transparency on;

- What is an inverted yield curve?

- What does the evidence and research show on its implications for your investment portfolio?

- How will we be managing your long-term assets based on this curve inversion?

What is an inverted curve and what’s it trying to tell investors?

A yield curve plots all bond maturities ranging from T-bills to 30-year bonds. In normal circumstances it has an upward sloping curve because bond investors expect more compensation for taking on added maturity risk.

On rare occasions, the yield curve inverts whereby shorter-term yields are higher than longer term yields. Last Wednesday, the US curve between two-year and ten-year bonds inverted for the first time since 2007.

Much has been written to suggest that when this inversion occurs it signals a coming recession. Recessions ultimately bring in lower equity prices. So, put it all together and market pundits often suggest that an inverted yield curve will lead to lower equity prices.

You might have recently read statements like each US recession since the 1970s has been preceded by an inverted yield curve. However, not all articles correctly report that the inverse does not always hold true. What the articles fail to mention is that every yield curve inversion however does not lead to an imminent recession and/or lower equity prices.

What does the evidence show?

- Investors would be better off by NOT timing equity allocations based on curve inversions.

- Staying fully invested over the long-term has provided a higher return than trying to time equity markets using curve inversion as a signal to change allocations

Below are the observations (evidence) and implications of inverting yield curves from the two (attached) research notes:

The Flat-Out Truth, November 2018, Dimensional Fund Advisors

- The small number of US yield curve inversions over the last 40 years makes it challenging to draw strong conclusions about the effect on stock market performance.

- Though the data set is limited, an analysis of yield curve inversions in five major developed countries shows that an inversion may not be a reliable indicator of stock market downturns.

Inverted Yield Curves and Expected Returns (Draft #1), July 2019 by Eugene F. Fama and Kenneth R. French

- They found “no evidence that yield curve inversions can help investors avoid poor stock returns”.

- They observed that “yield curves do not forecast the equity premium”.

- They concluded that “investors who try to increase their expected return by shifting from stock to bills after inversions just sacrifice the reliably positive unconditional expected equity premium”.

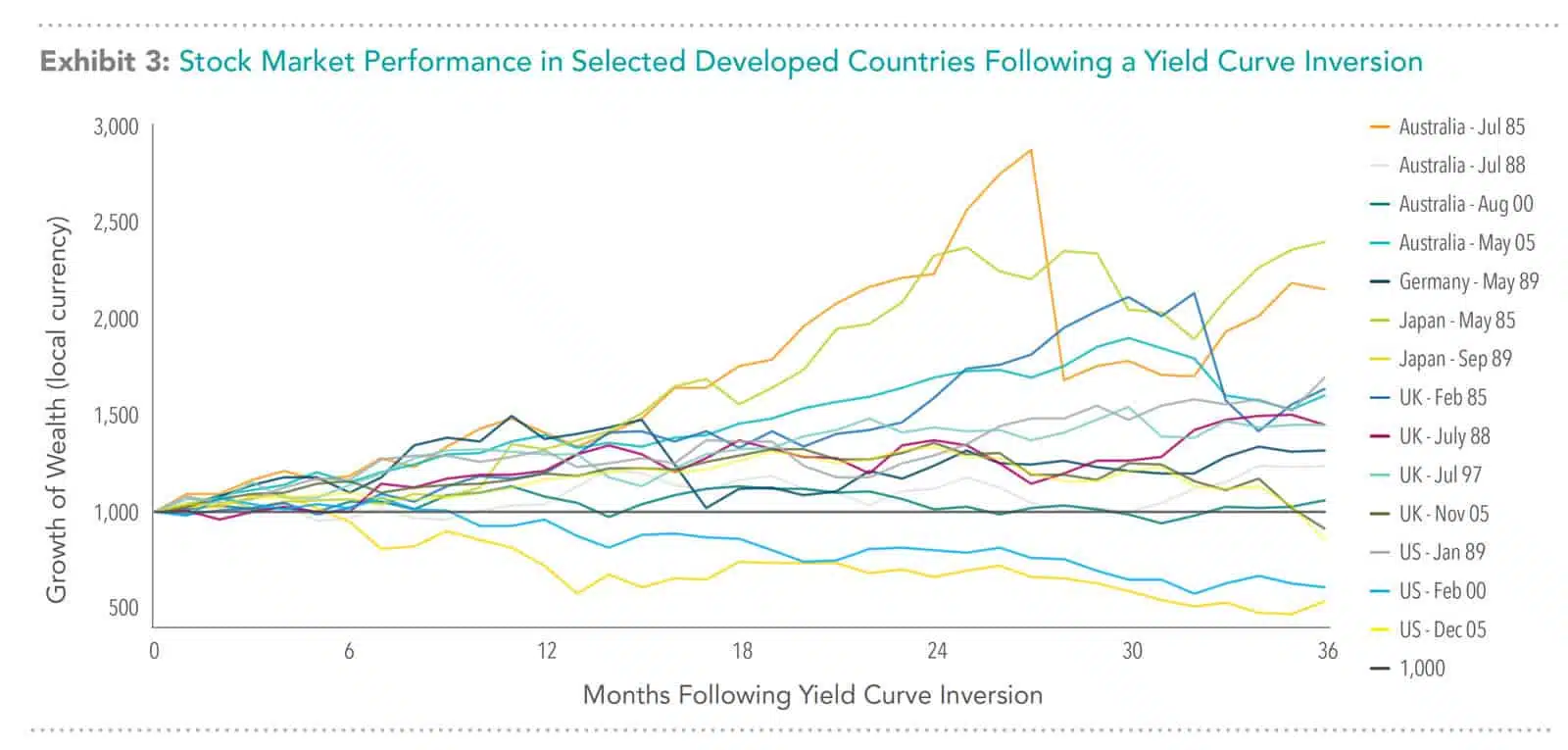

For investors who appreciate visuals, the chart below shows the 36-month historic local stock market growth after 14 yield curve inversions occurring in five major developed nations, including the US, since 1985. While the 2000 and 2005 yield conversions were followed by market corrections, many other yield conversions were not.

Stock Market Performance in Selected Developed Countries Following a Yield Curve Inversion

Source: The Flat-Out Truth, November 2018, Dimensional Fund Advisors

How will we manage your long-term assets?

- We will continue to develop and stick to your long-term investment plan. Your plan is in line with your risk tolerance and your financial circumstances.

- We will encourage and guide you to look past short-term noise and focus on investing in a systematic way using an evidence-based investment philosophy

- We will stay committed to the philosophy and rebalance through the ups and downs of various market conditions – including when we finally get our next recession.

We hope that you have found this information on yield curve inversions helpful. Please feel free to reach out should you have any questions.

Have a wonderful rest of the summer and our team looks forward to speaking with you soon.