You wouldn’t prepare to build a new home or renovate your existing one without first thinking through your vision, drawing up architectural plans, selecting the right contractors and tradespeople, and planning ahead for possible budget overruns and surprises. Yet many people approach their long-term investments without any plan at all. An investment policy statement (IPS) is a written document that you and your advisor create to keep you and your investments on track. The IPS brings clarity, vision, and discipline to the investment process. Think of it as a personal investment

Advisory Firm’s Investment Philosophy Pledge

If you’re building or managing investment wealth over the long term, you need to adopt a comprehensive investment philosophy that will guide you along the way. The IPS integrates your personal objectives and financial situation with your investment strategies and your investment philosophy. An IPS should spell out that philosophy and help you and your advisory firm put it into practice with the ongoing management of your investments. This also serves as a pledge by the advisory firm that determines how your portfolio will be managed. The following is an example of how an investment philosophy may be spelled out in your IPS using the principles of The Empowered Investor. The pledge below is from our firm’s IPS.

1. Consistent process for managing investments. “We have an investment process which includes the following components: a thorough know-your-client process, an investment policy process, standardized and consistent portfolio practices,

2. Diversified global approach to investing. “We take a global approach within the equity component of each client portfolio to enhance diversification and provide participation in equity appreciation opportunities worldwide. Portfolios will typically include: Canadian, U.S., International, and Emerging Markets equity exposure (unless otherwise stated in your investment policy statement).”

3. The inclusion of value and small cap companies. “We will include exposure to broad equity market, value companies and

4. Using asset class investments. “We will execute your portfolio strategy using asset class investment vehicles. By using passively managed asset class exposure we are able to provide our clients with full and consistent long-term exposure to

5. Rebalancing your portfolio. “We will rebalance your portfolio on a regular basis to ensure that it is in line with your long-term IPS “target” allocation. Our primary method of rebalancing is through cash flow management (deposits and withdrawals). When investing your deposits, we will buy asset classes that are underweighted relative to your long-term IPS targets. When raising cash to fund your withdrawals, we will sell asset classes that are

6. No market timing. “We will not engage in any form of market timing. We will not attempt to make any significant shift in weightings from stocks to bonds or vice versa based on economic forecasts or any “gut feeling.” We will not attempt to shift assets based on forecasts of business cycles (expansions or contractions) as they are too unpredictable. Not only would it detract from your investment returns, it would also add unnecessary risk and stress to your investment experience. Regular rebalancing will occur within Investment Policy Guidelines.”

7. No speculation” description=”We will not speculate with any portion of your investments.”

An IPS Provides Discipline and Structure

An IPS

Institutional investors have been using investment policy statements for decades. Ang and Kjaer report, for example, that the Norwegian sovereign wealth fund followed a stringent set of rules for rebalancing during the financial crisis of 2008–2009, buying equities while others sold in a panic. As a result, the fund enjoyed great success during the rebound that followed.

The IPS

An IPS is Your Living Document

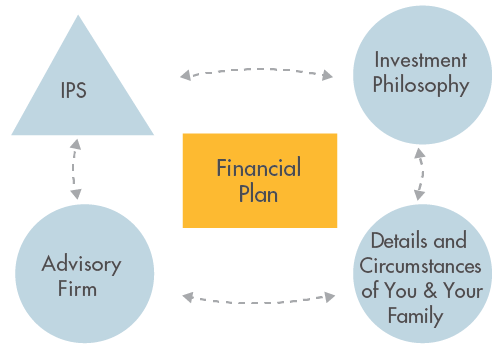

An IPS and a financial plan are not the same. The focus of an IPS is on the ongoing management of your long-term portfolio. A financial plan

Figure 1: Bring Your IPS to Life

There are many different components that form an IPS. Developing each of these components will require careful thought and analysis.

Your investment goals: Are you investing for capital preservation, long-term growth, or a mix of both? Are you currently adding new money to your portfolio, or are you drawing on it for income?

Your expectations: Based on your proposed asset allocation and asset classes to be used, you should learn and become aware of how they might work over long periods of time. What have good periods looked like and what

Your time horizon: Are you investing

Your understanding of risk: There are many types of risk for investors. IPS discussions should cover the following risks:

Volatility: The magnitude of the losses and gains that all

Financial risk: The dollar or percentage amount of decline you can accept, given your need for capital preservation, income and your overall level of wealth.

Emotional risk: The amount of decline you can accept without being tempted to abandon your strategy. This risk will vary based on your personality and previous experience with investments.

Purchasing power risk: The risk that your investment returns will not keep pace with inflation over time. Over long-term periods, this risk is typically higher with bond and GIC investments.

Longevity risk: The risk that an investor will outlive his or her portfolio. Implementing a sustainable annual draw-down is one way to help manage this risk.

Your asset classes: Which asset types (government bonds, corporate bonds, Canadian stocks, U.S. stocks, international stocks, etc.) will be included in your portfolio and which will be avoided? You should understand the characteristics of each of these asset classes, and how they have evolved over time.

Your asset allocation strategy: What will the portfolio’s strategic asset mix be? (For example, will the portfolio set a target of 60% equities and 40% fixed income?)

Your tax situation: What tax-efficiency strategies will be used to minimize taxes in non-registered accounts?

Your investment costs: What are the costs associated (at all levels) with the investment strategies?

Monitor, evaluate, and report: How will the portfolio be rebalanced back to the target allocation? How often will you receive statements showing your holdings, account balances, and performance?

Monitor, evaluate, and report: How will the portfolio be rebalanced back to the target allocation? How often will you receive statements showing your holdings, account balances, and performance?

Embrace the IPS Process – It’s Yours!

The process of creating and maintaining an IPS will ultimately empower you and your advisory firm to set the winning conditions for a better long-term investment outcome. The ongoing IPS dialogue with a trusted advisor will provide you with a better long-term investment experience by making you more aware of how markets work, allowing you to set realistic objectives and reduce the number of future surprises. The IPS also provides you with full transparency concerning the role of the advisory firm.

Your investment strategy should strike a balance between all the components mentioned above. You may choose to work with a qualified advisor to construct a customized IPS and then have the investment strategy executed, monitored, updated, and reported back to you. Or you may choose to create and monitor an IPS on your own.