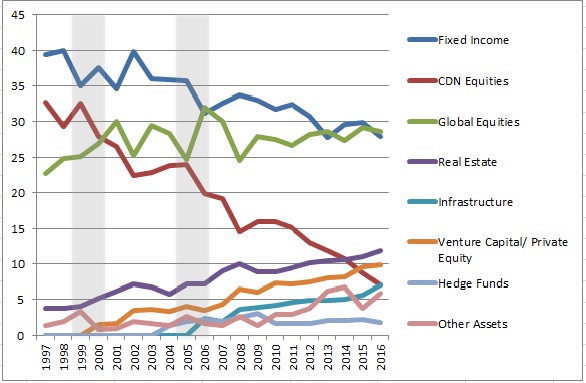

Below is a chart showing the evolving asset mix of Canadian Pension Plans over the past twenty years (1997 to 2016). The assets have been divided into eight categories: Fixed Income, Canadian Equities, Global Equities, Real Estate, Infrastructure, Venture Capitalism/ Private Equity, Hedge Funds, and Other Assets.

Figure 1. Asset Mix of Plans of Sponsor Organizations Represented By Members, 1997-2016

In the last twenty years, investors have experienced two major market corrections; the tech bust from 2001 to 2003, as well as the credit crisis of 2007 to 2009. Yet even at these major inflection points and turbulence periods, the Canadian pension funds maintained a relatively consistent asset mix year to year. The gray bands in the above chart highlight the two year period prior to these two market corrections. Prior to the 2001 correction, pension funds maintained a fairly consistent 35% fixed income position; while prior to the 2007 correction they actually decreased their fixed income position. The fact that no bold moves were made prior to those two major events is strong evidence that they were unable to identify opportunities to make bold moves in advance. Pension funds are managed by hundreds of investment professionals with access to the most sophisticated tools and data. They would also have access to all research available on how to possibly profit from market timing or aggressive portfolio shifts. I think it is fairly reasonable to conclude that if there were one group that had access to the right information to identify when to get in and out of the market at the right time, it would be the people managing pension funds. Yet with everything they have at their disposal, pension fund managers still avoid trying to time the market, which leads us to a fundamental question: if pension funds don’t engage in market timing, why would you? Market timing is one of the eight common pitfalls of investing, and it can easily lead to falling short of your investment objectives. Adhere to your investment philosophy, stay invested, and continue to prioritize your long-term goals.

_________________________________________________________________________________