Keeping you informed

Resource Articles

Investing Pitfall #2: Lack of an Investment Philosophy

An investment philosophy (also called investment strategy) is a set of guiding principles that shape and inform your decision-making process.

Investing Pitfall #1: Lack of an Investment Policy Statement (IPS)

The lack of a clear vision is the root cause of the majority of challenges faced by investors. An investment policy statement can help clear up confusion.

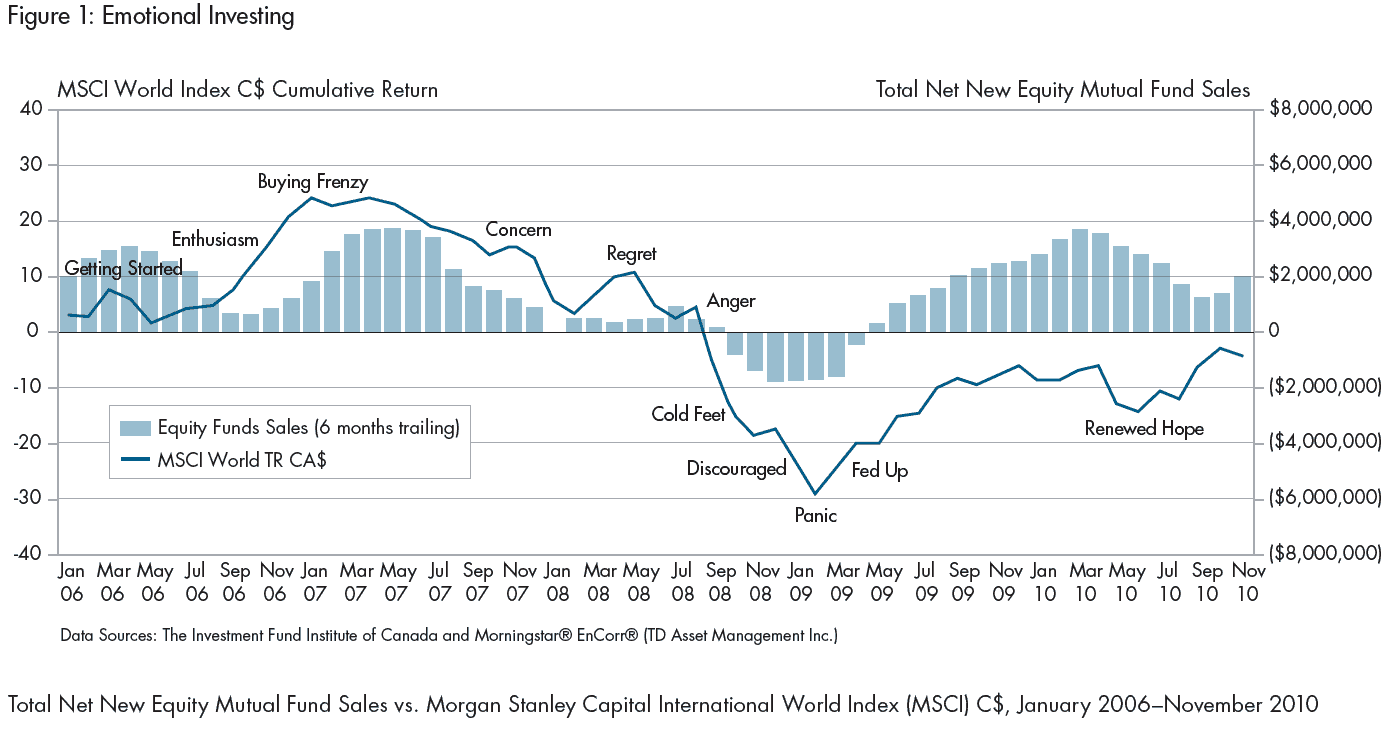

Why Behavioural Finance Should Matter to You

“I did everything right for ten years and I know all about investment pitfalls; but last year I let my emotions drive me to do something foolish—and it really set me back!” I can’t count the number of times I have met serious and smart investors who have told me...

A Return to Normalcy: Volatility Re-enters the Markets

Volatility is something beyond our control. That is why we focus our energy on areas that we can control

The Uncommon Average

Explore 'The Uncommon Average' at TMA Invest for expert investment strategies and market insights tailored to your financial success

The Registered Disability Savings Plan

Once in a while we can sit back and say that our Canadian government got it right. On December 1, 2008, the federal government implemented an important program to assist families with disabled children. The Registered Disability Savings Plan (RDSP) is an important...

Pension funds don’t engage in market timing, so why would you?

This article examines how the most sophisticated investment funds steer clear of the market timing pitfall, and why you should too.

SPIVA Data Reveals 15 Years of Active Underperformance

Discover SPIVA data showing 15 years of active underperformance. Explore insights into investment trends and performance analysis at TMA Invest.

Investment Shock Absorbers

Ever ridden in a car with worn-out shocks? Every bump is jarring, every corner is stomach churning, and every red light or sudden stop is an excuse to assume the brace position. Owning an undiversified portfolio triggers similar reactions.

Clearing Things Up: Transparency in Finance

Explore why transparency remains a challenge in the financial services industry. Discover insights and solutions at TMA Investment Advisors.

Presidential Elections and the Stock Market

Uncover the minimal effect of presidential elections on stock markets and why patient investing often leads to significant long-term gains.

Gifting Appreciated Investments: A Better Way to Donate

Explore tax-efficient strategies for donating appreciated investments. Learn how to maximize charitable contributions and minimize tax impact

Let’s Get Started

Connect

Visit Us

3535 St-Charles Blvd.

Suite 703

Kirkland, Quebec

H9H 5B9

Connect