Once in a while we can sit back and say that our Canadian government got it right. On December 1, 2008, the federal government implemented an important program to assist families with disabled children. The Registered Disability Savings Plan (RDSP) is an important step toward easing the financial burdens faced by many disabled individuals later in life. The RDSP allows parents to allocate savings that will help secure their children’s financial wellbeing many years down the road. While some families have the means to secure their child’s future, many others will be able to benefit from the RDSP’s ability to provide a stream of income to their child that would not have been possible before.

The RDSP was designed to provide a vehicle for families to accumulate funds under the umbrella of a tax shelter along with the assistance of government grants and bonds. While contributions are not deductible in the year they are made; the accumulating income and growth is sheltered (like RESPs) until it is withdrawn by the beneficiary and taxed in his/her hands. The RDSP also allows for the accumulation of savings without negatively impacting other government assistance.

The lifetime contribution limit is set at $200,000 with no annual limit. This means that the RDSP can be maximized right away should you wish to do so. However, that is not the approach we would recommend for reasons described later in this article.

Your annual contributions are met by a government grant of up to $3,500 per year, with a lifetime grant of $70,000. Beneficiaries of low income families are also entitled to a government bond of $1,000 for 20 years to a maximum of $20,000. No contribution is required to get the annual bond amount. A beneficiary is entitled to a $1,000 Canadian Savings Bond if his/her family income is below $26,364. Between $26,364 and $45,282 the amount is prorated and above $45,282 no amount is received.

For beneficiaries under the age of 18, these grants and bond amounts are dependent on their family’s income. Upon turning 18, the amounts are based on the beneficiary’s income alone.

The amount of the Canada Disability Savings Grant is calculated as follows:

For a beneficiary whose family income is less than $91,831 contributing $1,500;

- The first $500 contributed receives $3 of grant money for every $1 contributed up to $1,500 per year.

- For the next $1,000 contributed, $2 of grant money is received for every $1 contributed up to $2,000 per year,

The maximum annual grant is $3,500

The maximum bond is $1,000 for low income families.

Total money funding RDSP $1,500 + $3,500 = $5000 ($6,000 if family income is below $26,634)

For a beneficiary whose family income is greater than $91,831 contributing $1,500;

- Each $1 contributed will be matched by $1 up to a maximum of $1,000 per year.

Total money funding RDSP $1,500 + $1,000 = $2,500.

No bond is received.

To qualify for the RDSP, a beneficiary must meet the following criteria:

- Must be a resident of Canada when account is opened.

- Must have a Social Insurance Number.

- Must qualify for the Disability Tax Credit.

Contributions to an RDSP can be made up until the beneficiary turns 59. However, government grants are only available until the end of the year the beneficiary turns 49 so it is imperative you plan your contributions accordingly.

This is a fantastic program that can see up to $90,000 in grant and bond money being added by the government.

As mentioned earlier, you can contribute the $200,000 limit to the RDSP in Year 1 if you wish. While this allows for maximum sheltered growth, it would forfeit most of the government grant money due to the maximum annual grant limitations. Ideally, you would want to calculate a lump sum amount short of the $200,000 lifetime contribution limit that would leave you enough room to contribute the minimum amount each year until age 49 while benefitting from the annual government grant.

Similarly to other registered plans, you have control over the choice of investment strategies. Unlike RESPs, whose principle objective is to finance post-secondary education, the RDSP can be used for anything such as a down payment on a house, travel etc.

Fortunately, if you qualify for the RDSP and have not yet opened a plan, you can benefit from past grants and bonds by making a lump sum contribution. You can receive the full amount of grants and bonds from the last 10 years (but no earlier than the year 2008, in which the plan was implemented). This could represent significant amounts at the onset of the plan. Don’t worry about calculating the amount needed to catch up. As soon as you open an RDSP, the government will send you a letter stating the amount you need to contribute to receive past grants and bonds.

10 Year Repayment Rule and Proportional Repayment Rule

Care must be given to situations where grants and bonds paid into the plan may have to be repaid. The government has listed a series of events that fall under the “10 Year Repayment Rule” and later replaced by the less imposing “Proportional Repayment Rule,” where a plan holder must repay all grants and bonds received during the preceding 10 years to the Government of Canada. As such, plan issuers must hold back an amount in what’s called an “assistance holdback amount” to satisfy this potential liability.

The following are events quoted by Revenue Canada.

- the RDSP is terminated;

- the plan ceases to be an RDSP;

- prior to 2014, disability assistance payment (DAP) is made from the plan;

- prior to 2014, the beneficiary stops being eligible for the DTC;

- since January 1, 2014, the beneficiary stops being eligible for the disability tax credit (DTC) and an election to extend the period for which an RDSP may remain open is not filed by the plan holder;

- where a valid election to keep an RDSP open expires; or

- the beneficiary dies.

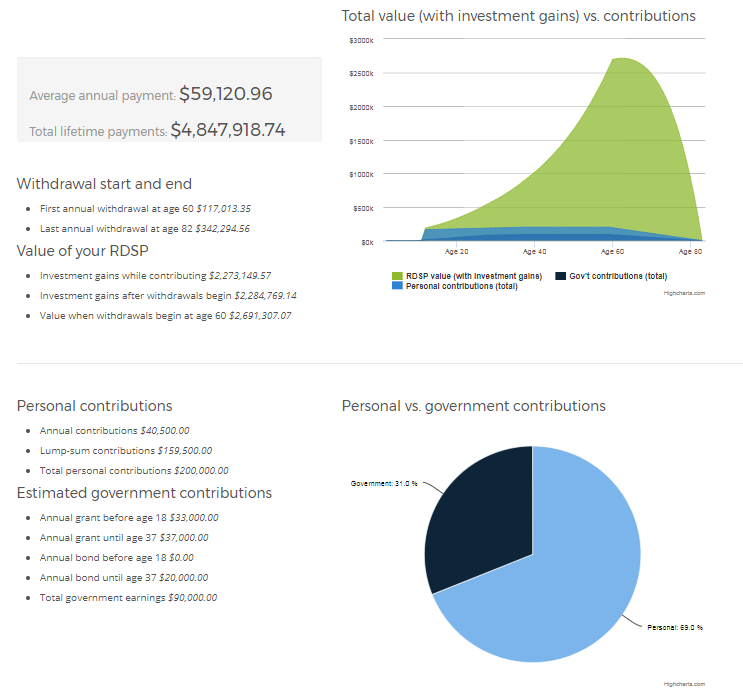

The example shown below in the graph demonstrates what a family with an income of $75,000 (assuming child is under 18) would accumulate over time by making annual contributions of $1,500 for 27 years with a lump sum of $159,500 in Year 2. We further assumed that the income of the beneficiary would be $20,000 per year after the age of 18 and a balanced-growth investment strategy is followed.

As you can see, the accumulation and payout to the beneficiary at age 60 are significant.

Under the 10-Year Repayment Rule, any small withdrawal from the plan who have forfeited all the grants and bonds received in the preceding 10 years. The new Proportional Repayment Rule reduced the repayment amount to $3 for every $1 withdrawn.

While we have tried to give you a brief overview of the Registered Disability Savings Plan, there are other elements to consider such as what would happen should a beneficiary no longer qualify for the Disability Tax Credit or die. Are investments considered non-qualified, and if so, what are their tax implications? Can RDSPs be rolled over to another RDSP? What happens when a Registered Retirement Savings Plan from a deceased individual is rolled into an RDSP of another eligible individual? Your advisor at Tulett, Matthews & Assoc. will be able to help you answer these questions and navigate the RDSP process.

If you believe that you and your family might benefit from such a program, we suggest that you contact your advisor at Tulett, Matthews & Assoc. to discuss its merits.