In 2005, W. Chan Kim and Renée Maubourgne wrote The Blue Ocean Strategy, a business management book that sought to change how companies competed. Their main argument was that a company needed to move from the “red ocean,” where it is engaged in bloody and ruthless competition in a discouraging and dwindling marketplace, to the “blue ocean,” where its strategies and offerings set it apart from its competition, creating a unique demand for its products and services. When companies create such a powerful, independent business environment, they are said to be operating in the blue ocean.

We’ve adopted and adapted Kim and Maubourgne’s metaphor to the world of personal investing to describe two investing environments—the murky ocean and the blue ocean. My goal as an advisor is to help people escape the stress of the murky ocean in favour of the peace of mind of the blue ocean. By doing so, investors will increase their chances of long-term investment success. The blue ocean is the ideal environment for you and your investments and the final destination of the empowered investor.

The Murky Ocean

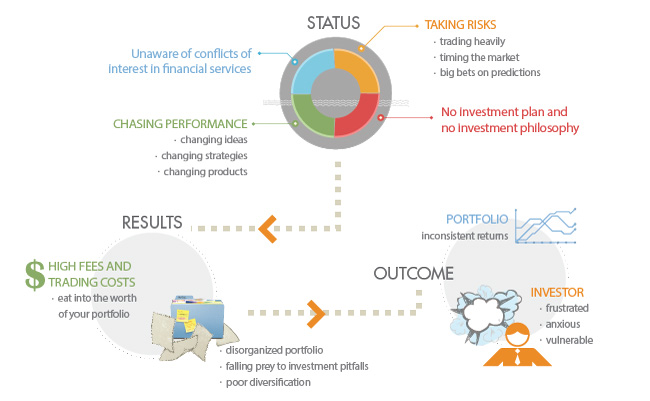

The environment of the murky ocean is chaotic and confusing. Without an investment plan or philosophy to guide you, you’re vulnerable to investor hype and market storms, and prone to anxiety and frustration. You may be unaware of the conflicts of interest at play in the financial services industry or unsure of how to navigate them. The sales forces from brokerage and mutual fund firms are constantly pitching new ideas, new strategies, and new products to you, encouraging you to follow active investment strategies that have you chasing performance, trading heavily, trying to time the market, and making big bets on predictions.

Figure 1: Life in the Murky Ocean

As a result, your investments are disorganized, heavily concentrated in one industry, or minimally diversified. High fees and trading costs eat into the worth of your portfolio and returns are inconsistent—even though your advisors promise that they have the inside scoop on selecting the next star performers.

In the murky ocean, a lack of clarity and transparency makes it difficult to understand how your money is being managed or why your advisor is recommending one investment over another. Feeling as if the investment process is out of your control feeds your fear that you may not reach your personal investment goals in time for your retirement.

The murky ocean is the worst place an investor can be. But with better education and awareness, investors can steer their investments into the blue ocean.

The Blue Ocean

In the blue ocean, your financial wellbeing is the top priority. It’s an environment that will help you avoid the shoals of conflicts of interest and the waves of market hype. And while it will not necessarily insulate you from market storms and the uncertainty of short-term price movements, understanding what you can and cannot control will help you weather those storms with much less stress and a higher chance of success.

The blue ocean is the clear, transparent environment you will discover by becoming an empowered investor and following the eight principles of successful investing. These principles can be summarized as:

1. Steer clear of the most common investment pitfalls.

Being aware of common investment pitfalls is half the battle. Ignore “expert” market predictions and resist the urge to chase star performers. Control your emotions so that they do not have a negative impact on your investment results. Be aware of the mathematics of sustainability and calculate how much money you will require for a financially independent future. Then build a plan that will ensure that you reach this goal.

2. Recognize conflicts of interest in the financial services industry.

By understanding how the financial industry works, you will be able to take better care of your money. A qualified, independent, fee-based advisor does not depend on commissions or sales fees and is able to offer unbiased advice and recommend the best tools in the marketplace.

3. Choose asset class investing.

Asset class investing has been proven to have a bigger impact on your portfolio than market timing or stock picking. It is the most important step in taking control of your investments.

4. Build a diversified portfolio that is highly structured, organized, and follows a rebalancing process.

A truly well-diversified portfolio will include: bonds, real estate investment trusts, Canadian large cap, value, and small cap stocks, U.S. large cap, value, and small cap stocks, International value and small cap stocks, and Emerging Market stocks.

Most investors and many advisors misunderstand the concept of diversification, believing that they are diversified because they own fifteen stocks or ten mutual funds. Too much overlap equals improper diversification and can be a recipe for disaster.

Your portfolio should be rebalanced on a regular basis to ensure that it is in line with your long-term “target” allocations.

5. Choose passively-managed, index-based or factor-based asset class investments that are tax-efficient.

Passively-managed, index- or factor-based asset class investment tools have been shown to consistently outperform actively-managed funds. Choose tools that are transparent, precise, tax-efficient, and flexible.

6. Discover that risk and return are related. Consider including small and value companies when designing your portfolio.

Use the Fama/French Three-Factor model to create the optimal portfolio structure for long-term success. This model shows that:

- stocks outperform bonds

- value stocks outperform growth stocks

- small company stocks outperform large company stocks

7. Create an investment policy statement (IPS).

An IPS defines your investment goals, describes your investment philosophy, and determines how your portfolio will be managed. A qualified, fee-based investment advisor can help you create an IPS that will keep your investments on track and within your specified risk parameters, greatly enhancing your investment experience.

8. Coordinate your investments with your life plan.

Investments and life should work together; a well-considered plan is crucial to ensuring that your dreams become financially viable.

Become the Investor You Always Wanted to Be

While we would all like to find our investments and ourselves in an environment like the blue ocean, simply wishing for it to happen won’t make it come true. Success in investing—as in life itself—is the result of hard work, proper diligence, and the application of the best strategies. The eight principles of successful investing, while interesting and worthwhile in and of themselves, become most powerful when integrated into an overall financial strategy.

Not only will you increase the odds that you will obtain better performance from your portfolio over the long term, but the side benefits are very real and very human. By taking control of the way you invest, you gain control of your future financial wellbeing. These methods won’t help you predict the future, but they will prepare you for it.

The last few years have been a trying time for investors worldwide. While we don’t believe in speculating on future market movements, we are confident that the principles and strategies discussed herein are the best guides on the uncertain road ahead. Their proven track record offers you the confidence and comfort of knowing that your investments are working for your interests, leaving you free to dedicate your energies and passions to the things that matter most: your family and friends, your business, and your retirement. By taking these steps, you’ve committed yourself to the task of creating long-term investment success. The blue ocean awaits.

| ASPECTS | MURKY OCEAN | BLUE OCEAN |

|---|---|---|

| Portfolio structure |

|

|

| Investors beliefs, behaviours, and actions |

|

|

| Investor outcomes |

|

|