Global Investors, Shared Values: A Conversation with David Andrew

Discover how global investors share common values in this conversation with David Andrew on independent wealth management, fiduciary advice, and long-term planning.

Discover how global investors share common values in this conversation with David Andrew on independent wealth management, fiduciary advice, and long-term planning.

Learn how RESPs work, how to maximize education savings grants, and avoid costly withdrawal mistakes. A must-listen for Canadian parents planning their children’s future.

Discover powerful personal finance tips with journalist Nicolas Bérubé as he shares proven strategies on mindful spending, gratitude, and wealth-building to help secure your financial future.

Discover how Trump’s tariff policies triggered market volatility and what it means for investors. Learn strategies to confidently navigate uncertain markets and economic turmoil.

Can tactical allocation boost returns? This episode breaks down Morningstar’s latest research on market timing, risks, and why long-term investing may be the smarter move.

Can investing in trends like AI or green energy boost your portfolio, or is it just another gamble? We explore the appeal and risks of thematic investing—and why sticking to core investments may be wiser.

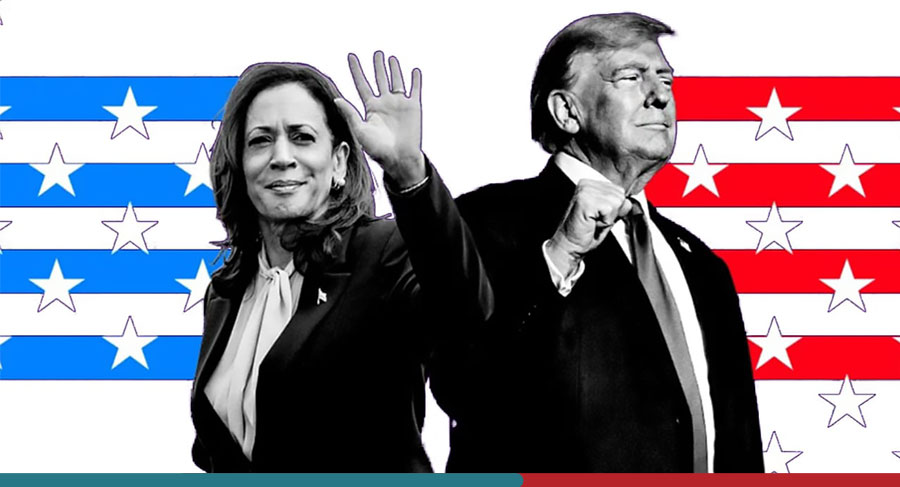

What is impact of trading on the U.S. election on your portfolio? We break down election myths and offer long-term investment insights for savvy investors.

Join our discussion on maintaining composure during market fluctuations, long-term investment approaches, and insights from Intel’s successes and setbacks.

Celebrate 100 years of mutual fund history, tracing their evolution from niche products to investment essentials. Explore their benefits: diversified exposure, easy access to foreign markets, and convenient trading. Confront their drawbacks: high fees, transparency issues, and sales-driven practices.

Wondering how you can simplify your investment strategy without sacrificing returns? Tune in as Nicolas Bérubé, an award-winning financial journalist and author, discusses the benefits of a stress-free investment strategy.

Have you ever wondered what happens to your tax obligations when you leave Canada to become a non-resident? Join us as we shed light on the often misunderstood and overlooked aspects of taxation for non-residents.

Can you quantify the value of financial advice? Dive into the intricate relationship between financial advice and investment success, featuring the insightful expertise of Emile Bouchard from Vanguard.