the empowered investor

Personal Financial Planning for Ages 25–35

Laying a Strong Foundation for Future Success

Key Takeaways

- Three key ingredients combine into a solid recipe for financial success for 25– to 35-year-olds: saving, investing, and making the right financial moves.

- For effective saving, get in the habit of paying yourself first: always set aside a portion of your income before spending the rest.

- Investing early makes the most of your youthful super powers: time and compound growth on your investments.

- Additional financial priorities include preparing for retirement (yes, really) and ensuring your debt load doesn’t become a drag on your future wealth. If you have dependents, basic insurance and estate planning come into play as well.

“Whether you’re graduating from university, you’re in a trade school, or you’re an entrepreneur, it’s critical to get off on the right start.”

Ah, the irony of youth. When you’re in your 20s to early 30s, retirement is probably the last thing on your mind. As we observed in our related podcast, “Laying a Strong Foundation: Financial Planning for 25 to 35 Year Olds”, today’s risks and rewards understandably loom larger than some vague event another lifetime away.

And yet, hands down, the best time to become an Empowered Investor is when you’re just getting started. In this first of three age-related financial planning posts in our Empowered Investor blog, we’ll talk about what it takes to build a strong foundation for your future, while also enjoying a meaningful life along the way.

In our last post, “Taking Control of Your Personal Financial Action Plan”, we introduced three key ingredients that combine into a solid recipe for financial success for 25– to 35-year-olds:

- Saving

- Investing over long periods of time

- Focusing on the right financial moves

SAVING ESSENTIALS: PAY YOURSELF FIRST

It’s hard to argue with the importance of saving … but easy to struggle with how to achieve it. Young families face Canadian housing prices that only seem to grow steeper over time. Weddings and babies are events to celebrate, but they can also take a bite out of your current income. So can paying off university debts.

And those are just the big-ticket items. In another recent podcast, “How to Start Saving and Investing”, young investors Ryan Jacobs (age 20) and Matthew McGee (age 17) noted how intoxicating it can feel to go on spending sprees once you no longer have to ask your parents for money. “When I worked throughout high school,” says Jacobs, “I did not think about savings back then. I just spent it as I pleased.”

The best way to lay a strong financial foundation is to get in the habit of always paying yourself first.

What do we mean by that? The expression comes from “The Richest Man in Babylon”, by George Clason. Although first published in 1926, the book is still in print, and every bit as important today—especially if you’re just getting started.

Have you received a gift, inheritance, or similar windfall? Started a new job or scored a raise? Received a tax refund? Whether it’s a little or a lot of income, always pay yourself first by setting aside a percentage of it for future expenses—and then you can spend the rest on today’s wants and needs. By routinely saving before spending, you’re less likely to miss the extra money today, and more likely to have what you need for tomorrow. You can stretch your future dollars even further by saving them into registered accounts, where your investments can benefit from tax-sheltered growth.

How much should you save? The sooner you start paying yourself first, the less you have to dedicate to the effort. Fidelity’s Global Retirement Savings Guidelines suggests saving 16% of your income if you start at age 25. If you wait until you’re 30 to get started, you’ll need to save 20% to achieve similar results. And so on as you grow older.

This brings us to our next point … the magic of compound growth.

INVESTING ESSENTIALS: TIME AND MONEY

Once you’ve saved some scratch, the next step is to invest it in the markets … and leave it there for decades. Again, investing even a little bit at an early age boosts your ability to make the most of your youthful super powers: time and compound growth, or the snowball effect of growth on the growth of your investments.

Say, for example, you invest $100, and it earns 5% annually for 20 years. At the end of Year 1, you’ve earned 5% on $100, or $105. After that, in Year 2, you earn 5% on your new total of $105, yielding $110.25 … and so on. The longer your money can compound in this fashion, the more “growth on growth” you gain.

For a simplified example, let’s say 25-year-old Jane adds $2,000 annually to her investment account until she reaches age 70—for $90,000 total—and she earns 7% annually on her investments. Joan does the same, but waits until age 35 to get started, setting aside $70,000 by the time she is 70. How do their results compare? Jane’s portfolio grows to $613,000 by age 70. Joan ends up with less than half that amount at $297,000. What a difference those extra 10 years of compound growth can make!

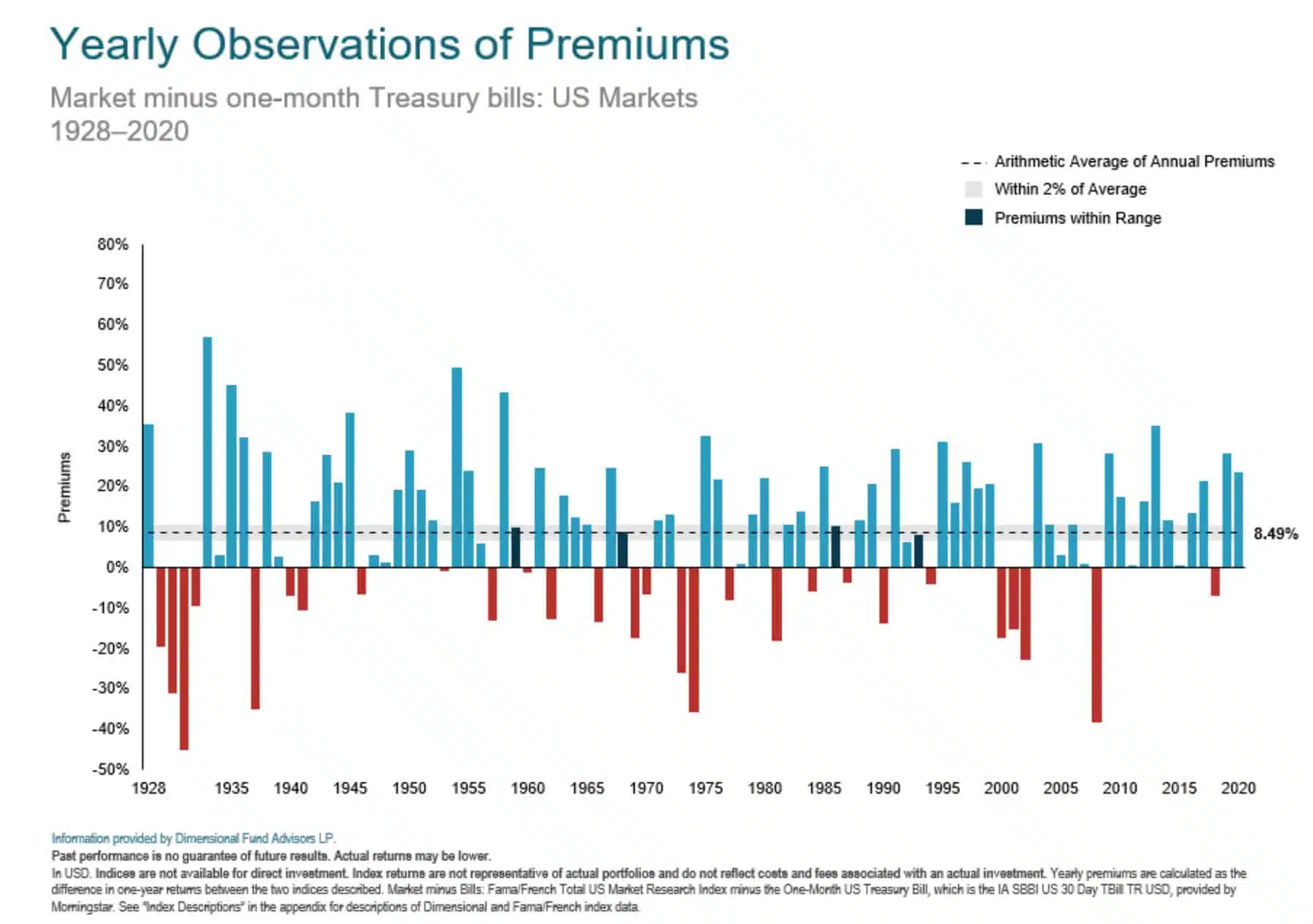

Again, this is an oversimplification. You can’t actually count on a consistent return every year, nor can we predict exactly where the premium returns will come from when they occur. Across time and various markets, you’re much more likely to see the kind of performance illustrated here for the U.S. stock market. There’s an overall positive premium, but it’s rarely close to “average” from one year to the next.

The takeaway? Because young investors typically have decades to ride out markets’ bumpy, if overall upward courses, you can consider investing most of your portfolio in more volatile global stock markets and their higher expected returns—but only if you actually sit tight, and don’t react to the market’s sudden movements.

Especially when you’re younger, benign neglect may feel unnatural. We’re long taught, if you want to get somewhere in life, you should give it your all. But consider these wise words from Fortunes & Frictions financial author Rubin Miller:

“If you want to be an elite doctor or lawyer – wake up early, study hard, try to attend great schools. But if you want to be an elite equity investor, simply buy the global stock market for a low cost, and get the hell out of the way.”

BEYOND INVESTING … WHAT ELSE?

As we touched on in our last post, establishing excellent saving and investing habits is a critical cog in your financial planning engine. But so is managing your retirement, debt, risk, estate, and tax planning.

How do you tackle all that, and still manage to have a life? In our “Foundational Planning podcast”, we described the highest priorities for investors in their 20s and 30s.

- Saving for Retirement: While funding a TFSA may be more appealing when you’re younger, allocating at least a portion of your savings to an RRSP is a powerful, yet often overlooked best practice. Financial analysis suggests, your CPP or QPP pension and OAS alone are unlikely to sustain your standard of living in retirement, let alone improve on it. A well-funded RRSP can bridge that gap. Plus, once money is earmarked for retirement, you’re less likely to spend it, which gives it time to grow, untouched.

- Debt management: Just as compounding growth can accelerate your earliest investing, early debt digs your hole faster and deeper over time. A low-interest home loan may be warranted, providing you have a disciplined plan for paying it off. But minimizing, if not eliminating high-interest lines of credit is essential to a successful financial outcome.

- Risk management: If you’re single with no kids, you may be able to hold off on securing life and disability insurance. But if you have dependents, what would happen to them if your career were put on hold … or worse? Hedge this risk with some basic coverage; when you’re young, the premiums should be minimal anyway.

- Estate planning: Again, basic planning should suffice: If you’re on your own, who gets what if you die? If you have kids, who will be their guardians and financial trustees? A modest effort here can make a huge difference if worse comes to worst.

- Tax planning: Beyond establishing and funding your registered accounts, tax planning is another area requiring less attention when you’re younger. You should have decades ahead before you’ll need to tap into those accounts in a tax-wise order.

SETTING THE STAGE FOR YOUR POWER PLAYS

Once again, saving, investing, and establishing your financial priorities are key to creating a strong foundation when you’re in your 20s to mid-30s. What’s next? Once you’ve hit your career stride, you can start building on your foundation with some important power plays, which we’ll cover in our next post. In the meantime, if you have questions or comments about what you’ve read so far, please reach out to us today. We’d love to hear from you!

Additional Reading:

- The Richest Man in Babylon: George S. Clason

- Global Retirement Savings Guidelines: Fidelity

- Fortunes & Frictions: Rubin Miller

More Winning Investment Principals

Investment Principal #4: Maximize Returns with Key Investment Factors

Discover how investment factors can help you maximize returns. Learn strategic factor investing to enhance your portfolio.

Investment Principal #3: Using Passive/Index Funds or ETFs

Index-based or passive asset class funds focus on how to reduce the costs and frictions involved in capturing the market’s generous expected returns over time.

Investment Principal #2: Diversify Your Asset Classes

The magic behind diversification is found in a financial measure known as correlation, or the degree to which two asset classes move in similar patterns.

Stay on top of your financial education

Subcribe and follow to get updates on important wealth management topics.

Connect

Visit Us

3535 St-Charles Blvd.

Suite 703

Kirkland, Quebec

H9H 5B9

Connect